Running the Year End Routine manually for Tax

This support note applies to:

- AO Tax (AU)

- AE Tax Series 6 & 8 (AU)

- AE Tax (AU)

These instructions require technical expertise

Make sure you know what you're doing and are using one of the products listed. If you're not sure, ask your IT professional or MYOB.

In MYOB Tax you may wish to manually run the Year End Routine Steps. The Year End Routine covers the following areas:

- Carries the Front cover details to the subsequent year's front cover.

- Sets Overseas pension and salary income dates to the next financial year.

- Brings locked returns into the new Tax ledger and keeps them locked.

- Resets lodgment levels and due dates according to the options you select.

- Updates Primary Production Averaging Income years dropping off the earliest and adding the immediate prior year.

- Updates Special Professional Eligible Income for Averaging years dropping off the earliest and adding the immediate prior year.

- Provides a checkbox to Clear Invoice amounts.

The instructions are based on running a Year end routine for the 2018 tax year.

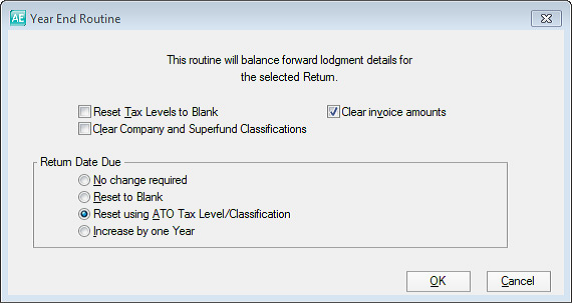

The Year End Routine descriptions

The following provides details on each of the Year End Routine options:

Reset Tax Levels to Blank

By selecting this option, the ATO lodgment level of every return transferred from the previous ledger will be reset to blank.

If the Reset Tax Levels to Blank option is not selected, the ATO lodgment levels for the return:

- Will be based on the previous year's assessment details;

- If no assessment details were keyed in, it will display the previous estimate details or

- If no estimate was produced, it will be based on the previous lodgment level.

Clear Company and Superfund Classifications

This option clears the Company and Fund classification field on rollover. The Company and Superfund classification field is located on the PAYG/Lodge tab (from the Return index select Properties > PAYG/Lodge).

Clear invoice amounts

If you want last year's invoice amounts to rollover, you must remove the tick from this box. If this option is not ticked, you when select OK you must confirm that the invoice details should roll forward.

Return Date Due

The Return Date Due option will be effective for all returns brought forward. Depending on your practice requirements, select one of the four options:

- No change required: The return retains its previous due date.

- Reset to Blank: The new due date is set to blank.

- Reset using the ATO Tax Level/Classification: The due date is determined by the new tax year's lodgment level of the return, as determined by the Tax Office. This is the most commonly used Return Date Due option.

- Increase By one Year: The due date is advanced by one year. For example, if a date due field was 15/05/2017 it will become 15/05/2018.