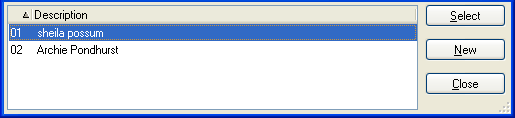

Interest on no-TFN tax offset worksheet (ito)

The Interest on Tax Offset worksheet assists with the calculation and record keeping requirements for claiming both the no-TFN Tax Offset at item 12 E2 in the Fund and item 13 E2 in the SMSF and any interest on overpayment due to the fund as a result of a member subsequently notifying their TFN.

The worksheet is therefore able to be opened from both labels E2 and H6 in the calculation statement.

For the worksheet calculation fields to be active, you must answer the 5 questions relating to the above mentioned conditions for claiming both the no-TFN tax offset and any interest on no-TFN tax offset. If the answer to any question is N (no), there will be no entitlement.

This is a multiple worksheet and allows for individual member calculations, the sum of which will be included at the relevant items and labels in the return.

As can be seen from the above screen shot, the first two fields calculate the no‐TFN tax offset which effectively a refund of the no‐TFN contributions additional tax of 32% (includes 2% Medicare levy).

The interest is payable on each amount of interest-bearing tax and interest on the tax that counts toward the no-TFN tax offset is calculated for the period between the later of:

the day on which the amount of interest-bearing tax was paid, or

the day by which the amount of interest-bearing tax was required to be paid AND

the date on which the current year assessment is made. The assessment is deemed to be made on the date the Fund lodges its Income Tax Return for the current year.

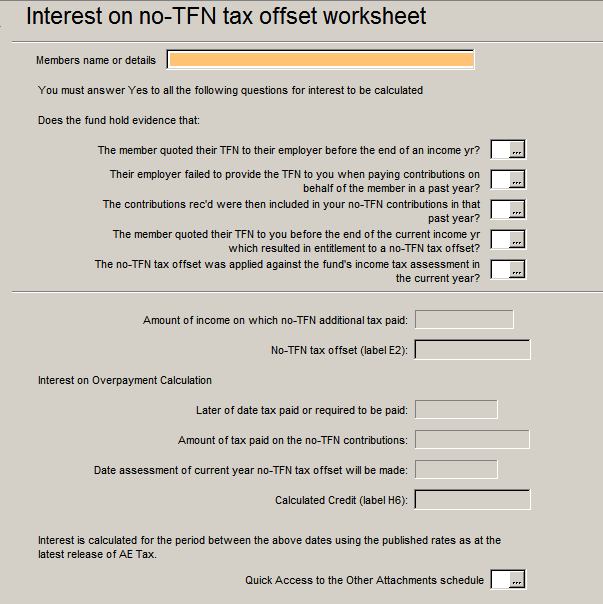

The rate of interest payable is the base rate determined under section 8AAD of the TAA 1953. Interest rates have been provided up to the quarter ending 31 March 2018.

Interest rates after that date will be updated as and when they are published. A table of Interest on Overpayments is provided in the Maintenance > Tax Rates > Interest on Overpayments.

As can be seen from the above, the last three quarters of the 2017-18 year will use the latest published IOP rate until the next quarter’s rate is published. If the next quarter's rate is published before MYOB provides an updated Service Pack, you will be able to key the new interest rate so that the claim at label H6 is as accurate as possible and does not advantage or disadvantage the taxpayer if there is a swing one way or the other.