Item 7 - Electronic Funds Transfer

The account details provided previously are NOT retained when the return is rolled forward. You must complete the bank details each year

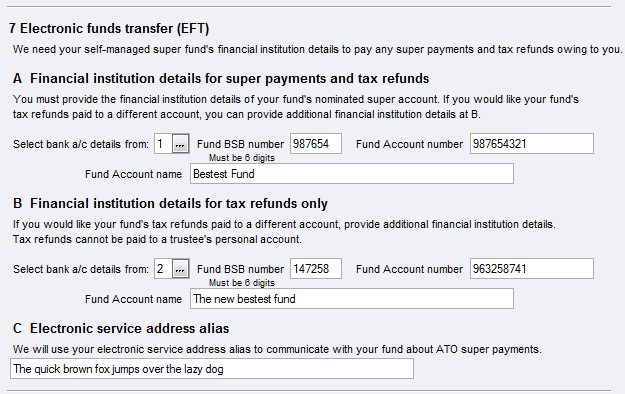

This consists of three parts, A, B and C:

There are two sets of fields provided for Bank details A and B.

C is to advise the Electronic service address (ESA).

A & B - Bank details

The first set of bank details fields A is the account to which the ATO will make super payments, and also pay refunds unless you have a separate account for receiving refunds. Do NOT enter the bank details of the Agent’s Trust Account at A. This field is mandatory as the Fund must have a financial institution.

Do not insert a tax agent's financial institution account details at A. The details at A must be for a financial institution account that belongs to the SMSF. Complete B if you want tax refunds to go to an account that does not belong to the SMSF.

The ATO will not use the details at A if they are for a tax agent's bank account.

If refunds are to be received into the Agent’s Trust Account, you will need to complete the bank details fields at B.

Follow the screen instructions and only complete part B if the details at B differ from those at A.

You may select pre-recorded bank details for the SMSF or for the Agent’s trust account where the refund will be paid directly to the Trust account.

To complete these details, select from the list at the prompt Select bank a/c details from:

A: 1 or 2 - Up to two sets of bank account details may be stored in the Return Properties, Bank A/cs tab and either of these may be selected from the list provided on the front cover. Refer to Return Properties - Bank a/cs.

B: If the Tax Agent uses a Trust Account to receive refunds, then these Bank Account details may be used by selecting ‘Agent’ from the list:

If an agent is selected on the Return Properties Staff tab the account details will default from those recorded under Maintenance > Agents > Properties > Banking tab for the Agent named on the Staff tab. Refer to Banking Details for Agents.

If the agent on the Return Properties Staff tab is blank, then the account details will default from those recorded for the Practice under Utilities > Control Record > Banking tab. Refer to Setting up your Control Record Properties for Banking.

Alternatively, enter the details directly into the fields provided at this item:

The bank state branch (BSB) number. This six-digit number identifies the financial institution. Do not include spaces, dashes or hyphens in the number.

The Account number. You cannot use an account number with more than nine characters. Do not include spaces in the account number.

The account name, as shown on the fund’s account records with spaces between each word and between initials. If the fund's account name has more than 32 characters, provide the first 32 characters only. Do not abbreviate the first 32 characters in any way.

If these details are incomplete or incorrect, no EFT will take place.

Direct debit

For information phone the ATO 1800 802 308 or download the direct debit request from the ATO website.

C - Electronic Service address alias

SMSFs that receive employer contributions (other than from an employer that is a related-party) are required to have an electronic service address (ESA) obtained from a registered service provider to enable electronic remittances to be sent when employers make super contribution payments. The ESA will also be used by the ATO to inform you of any super payments made to the SMSF by the ATO.

Enter at C your electronic service address alias. The ATO will use it to send electronic remittances of ATO super payments that it makes to your SMSF.

An ESA is not an email address, not is it of the SMSF or the contact details of the SMSF messaging provider.

If your SMSF does not have an ESA, you will be sent a manual remittance about any super payments made to your SMSF.

For more information about getting an electronic service address, see SMSF messaging providers.