Agent Reports homepage

The Agent Reports homepage is where you schedule or request agent reports from the ATO's practitioner lodgment service (PLS). These reports replace the ATO's ELS reports.

What reports are there?

- Activity statement lodgment report (ASLR)

- EFT reconciliation report (EFTRS)

- Income tax client report (ITCRPT)

Reports are either Scheduled or On-Demand (depending on the report).

To open the Agent Reports homepage, select the Tax drop-down and click Agent Reports.

How to schedule reports?

The video below shows the PLS features included in MYOB Tax version 2018.1 onwards.

Go to Chapter 6 to see how the agent reports work.

This video also covers PLS activity statements. If you want to view specific chapters, click the

The ASLR shows all your outstanding activity statement obligations.

This is a scheduled report. When you've scheduled the daily report for an agent, you can view it on the Activity Statement Obligations homepage.

Schedule the report to run after hours so that your pre-fill data is available the following day.

It is important that you only run the report once per day for each agent. If you reschedule it to run again on the same day, you'll get an error from the ATO (CMN.ATO.ODRPT.EM1001 — Only one 'Whole of Agency' report can be requested per day).

It takes approximately 1 hour to retrieve the report.

If you schedule the report to start today, but the start time has passed, the report is requested immediately.

The ATO restricts retrieval of the report between 9pm and 6am for agents with more than 20,000 clients.

- Open Agent Reports from the Tax button menu.

- Select an agent from the Agent drop-down.

- In the Report column of the table, select Activity Statement Lodgment Report from the drop-down.

- On the Tasks bar, click Request/Schedule Report.

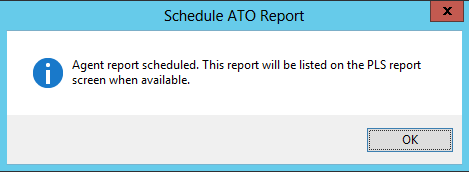

- On the Schedule Agent Report window, select a time from the Schedule time drop-down and click OK. The Schedule ATO Report dialogue appears.

- Click OK. The table is updated with the Schedule time and a status of Report Requested.

The EFTRS provides details of EFT refunds expected to be deposited into a registered agent's trust account. The report has similar data to the ELS EFT Reconciliation Statement.

The ATO recommends agents reconcile their account with the EFTRS before issuing payments to clients.

The EFTRS is an automated scheduled report. The report will only be available on a business day where a deposit is expected to be credited to the trust account.

Scheduling the EFTRS:

- adds tax agent trust financial institution account details using the manage agent trust (MAT) service.

- subscribes to it using the manage report subscription service (MRPTS).

- retrieves it using the get report service (GRPT).

Before scheduling the report, check that the bank details are correct in either the

- Maintenance > Agents > Agent Properties > Banking tab or

- Utilities > Control Record > Banking tab.

- Open Agent Reports from the Tax button menu.

- Select an agent from the Agent drop-down.

- In the Report column of the table, select EFT Reconciliation Statement.

- On the Tasks bar, click Request/Schedule Report.

- Click Request Report.

- On the Schedule Agent Report window, select a time from the Schedule time drop-down and click OK.

When you've received the report, you can view it from the PLS reports window.

Missing EFT reports?

The ITCRPT lists the clients that you'll be completing tax returns for. The report has similar data to the old ELS Due lodgment and Client list reports. The Client list report had similar print, update and sort options, but the tax level value isn't provided in the new ITCRPT.

The ITCRPT is an on-demand report and is available for 90 days after it's created.

- Open Agent Reports from the Tax button menu.

- Select an agent from the Agent drop-down.

- In the Report column of the table, select Income Tax Client Report.

- On the Tasks bar, click Request/Schedule Report.

- Click Request Report. When you've received the report, you can view it from the PLS reports window.

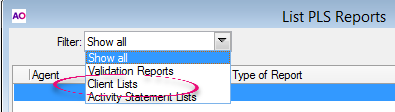

- In the Agent Reports homepage, click PLS Reports on the Tasks bar.

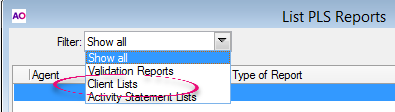

- In the List PLS Reports window, from the Filter drop-down select Client Lists.

- Select the Client List report and click OK.

- Select the View ATO Report and click OK.

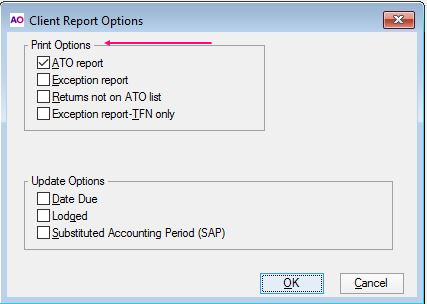

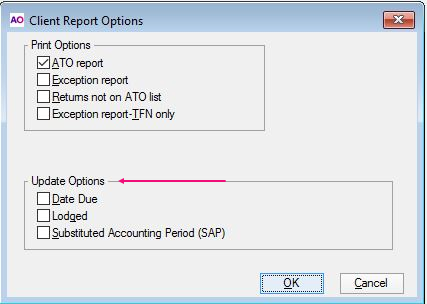

In the Client Report Options window, select your required Print Options and click OK.

Do not select any Update Options.

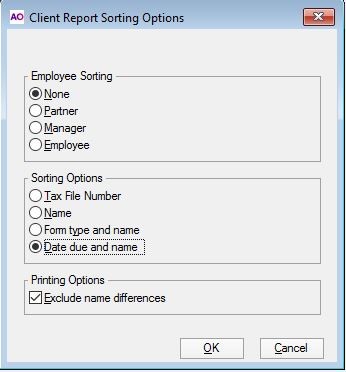

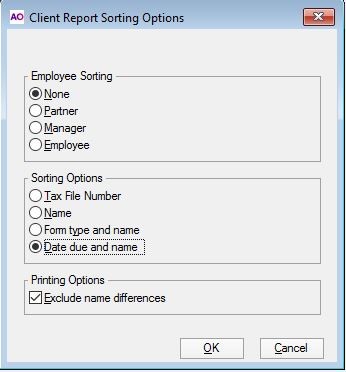

In the Client Report Sorting Options window, select the required sorting option and click OK.

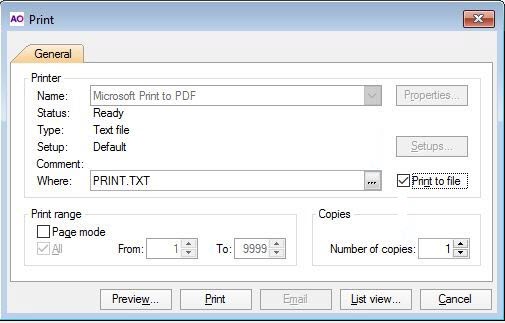

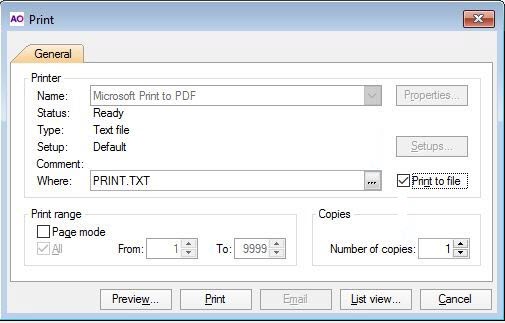

In the Print window, select Print to file.

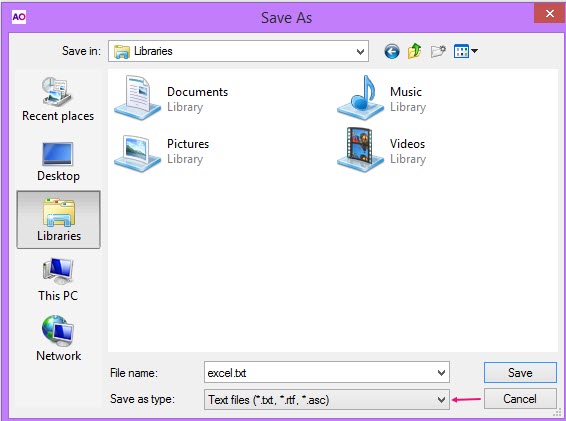

In the Save As window, enter a file name for the file and specify the location to save the file.

Leave the Save as type as Text files (*.txt,*rtf,*.asc).

- Click Save.

- In the Print window, click Cancel. The Print window closes.

- Open Excel.

- Go to File and select Open.

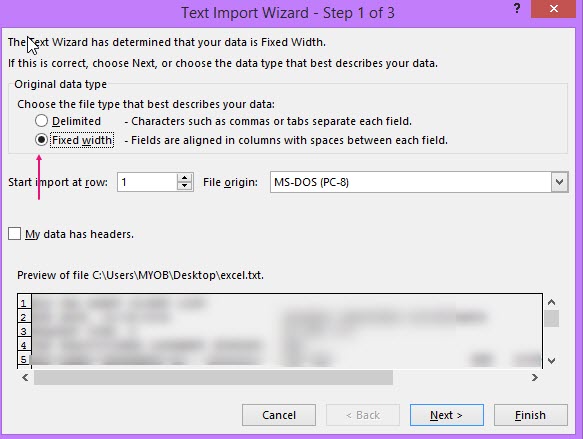

- Browse to your saved file and double click it. The Text Import Wizard - Step 1 of 3 window opens.

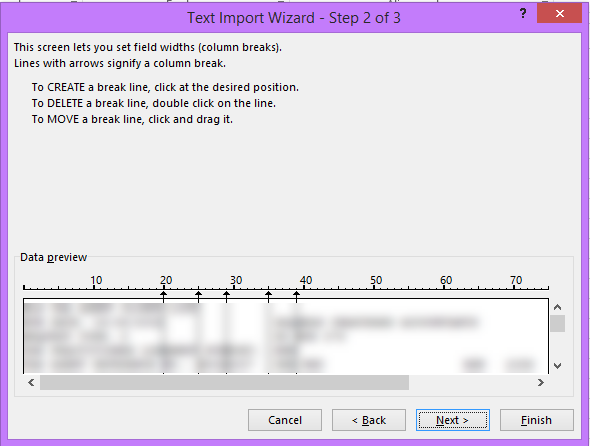

- Select Fixed Width and click Next.

Click Finish.

The file opens in Excel.Adjust the column widths as required.

- In the Agent Reports homepage, click PLS Reports on the Tasks bar.

- In the List PLS Reports window, from the Filter drop-down, select Client Lists.

- Select the Client Lists report and click OK.

- Select the View ATO Report and click OK. The Client Report Options window opens.

If applicable, select Date Due and/or Substituted Accounting Period (SAP) from Update Options and click OK.

Do not select Lodged.

We don't recommend selecting the Lodged option as it will override lodgment statuses for your returns.

The Client Report Sorting Options window opens.

Select the required sorting option and click OK. The Print window opens.

Click Preview to view the details of the report.

You'll see the due dates imported in the tax returns in the Tax homepage.

| Activity statement lodgment report (ASLR) | EFT reconciliation statement (EFTRS) | Income tax client report (ITCRPT) | |

|---|---|---|---|

| Scheduled? |

|

|

|

| Availability | Daily. Can only be requested once per day. | On business days where a deposit is credited to a trust account. | On request. |

Other tasks

If an agent leaves a practice, you'll need to unschedule any scheduled reports for that agent.

If an agent changes their trust bank account, you must unschedule the report, then reschedule it after changing the banking details. You'll then receive the EFTRS for the new bank account

We've disabled Unschedule report for on-demand reports, and for scheduled reports that haven't been scheduled for the agent.

- Select an agent from the Agent drop-down.

- Select the relevant report and click Unschedule report on the Tasks bar.

- Click Yes.

To check if an agent has onboarded

- On the Tasks bar, go to Practice > PLS Agent Settings. A list of registered PLS agents is displayed.

- A green tick in the Authorised column indicates an onboarded agent. A red cross indicates an unauthorised agent.

To onboard an unauthorised agent

- Click Authorise and follow the onscreen prompts. See Registering multiple ABNs for more information.