Activity statements homepage 2023

To open Activity Statements select it from the Tax button menu. All the activity statements for the current year for all agents in the practice are listed.

(AO) Source — indicates whether the activity statement was imported from your prior tax management software or not.

Return Name — the name on the client’s income tax return. To open an activity statement click the Return Name.

Client Code — click the Client Code to open the Client page.

DIN — the Document Identification Number for the activity statement. Each Activity Statement for the taxpayer must have a unique DIN unless it's a revision. Each revision must contain the original DIN.

Form Type — the type of activity statement.

Period Start — the start date for the period which the activity statement covers.

Period End — the end date for the period which the activity statement covers.

Status — the current status of the activity statement which can be In Progress, Sent for Signature or Lodged.

Date Due — the date the activity statement is due to be lodged. This date is the official due date which is closest to the Period End date.

Date Lodged — the date on which the activity statement was lodged.

Payable / Refundable — the amount of tax payable or refundable as calculated.

Agent — the agent reference number relevant to the activity statement.

The right-click menu provides filters for you to refine the data displayed:

to show data for All agents or a selected agent.

to display data from the Prior Year or Current Year.

to filter the activity statements, by selecting a Range:

September quarter

December quarter

March quarter

June quarter

Last month or

- ALL (no filter applied).

to restrict the Status of the statements listed to those with status ‘lodged’ or alternatively to those with status ‘not lodged’. Initially, the display shows statements that are ‘not lodged’.

Activity Statements Tasks bar

The tasks available here are to simplify requests for ATO ELS reports to reconcile your tax data and to create and update activity statements. The tasks are grouped as Reports, Preparation and Lodgment and are described briefly here.

Select for Lodgment and the menus to request, retrieve or generate ELS reports are disabled if you've upgraded to version 2018.1 or later. You should use the Activity statement obligations homepage (ASO) 2023.

The Reports tasks involve AS and OM reports.Reports

Activity statement client list - AS (Solicited report)

Activity statement summary report - OM (Unsolicited report)

The Reports tasks simplify preparing a Tax Agent Report Request (RR) for a selected agent by pre-filling and filtering for relevant information. The tasks are:

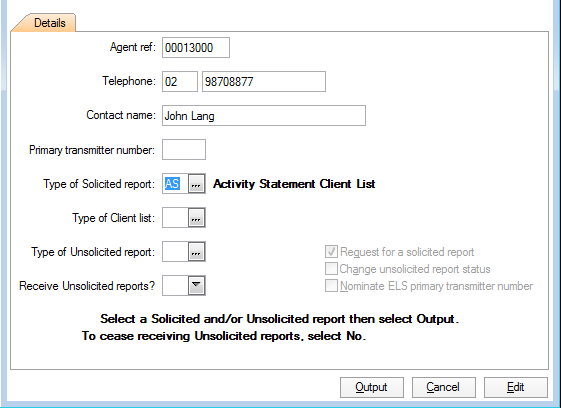

This function prepares a Form RR requesting one solicited report. The default report is set as the ATO Activity Statement Client List (AS). This report identifies your clients who need to have their BAS or IAS payer details updated on the Return Properties General tab. To do this:

- Select Request solicited report (AS). Highlight an agent from the list displayed.

- Click Request. The Tax Agent Request Form opens pre-filled for the Activity Statement Client List (AS).

- Click Output. The message “Are you sure you want to send this Report Request during next lodgment?” displays.

- Click OK. The Form RR is now prepared and ready for lodgment. The message “Print Report?” displays.

- Click Yes.

- Complete your printing requirements in the Preview/Print screen.

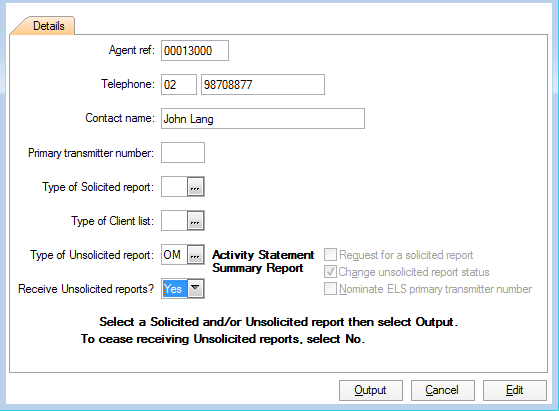

This function prepares a Form RR to request one unsolicited report. The default report is set as the ATO Activity Statement Summary Report (OM). This report identifies your clients who have not lodged an activity statement in Tax that matches the DIN recorded for them at the ATO.

To request the report:

- Select Request unsolicited report (OM). Highlight an agent from the list displayed.

- Click Request. The Tax Agent Request Form opens pre-filled to request the Activity Statement Summary Report (OM) and to receive unsolicited reports.

- Click Output. The message “Are you sure you want to send this Report Request during next lodgment?” displays.

- Click OK. The Form RR is now prepared and ready for lodgment. The message “Print Report?” displays.

Click Yes to prepare the Tax Agent Report Request for preview and print.

Complete your printing requirements in the Preview/Print screen.

This function retrieves any reports available for the agent selected. You can also select a report for review from the report types listed. As well as AS and OM you can also review reports generated from within Tax including Due Report, Lodgment Report and Lodgment Status (State) Report.

The Preparation tasks are designed specifically for the AB/AI reports:

Outgoing business activity statement - AB

Outgoing instalment activity statement - AI

Retrieve BAS/IAS (AB/AI)

This function connects to the ATO to retrieve reports ready for download. During this connection, all reports not yet downloaded will be downloaded to the selected agent’s electronic mailbox.

Review BAS/IAS (AB/AI)

You can select an AB or AI report from those previously downloaded for the selected agent. The report can be printed and reviewed. If you accept the data on the ATO report you can use the next task to Generate BAS/IAS to create the statements.

If the report is adequately reviewed you can use the next task to Generate BAS/IAS for this report.

Generate BAS/IAS (AB/AI)

Select an AB or AI report from those previously downloaded for a selected agent. The main purpose is to Update/Create schedule for ATO report. This routine creates activity statements from information in the ATO report and will overwrite any existing schedule when selected. This routine records an audit trail of changes.

See Preparation example: Generate BAS/IAS (AB/AI).

Import data from Banklink/GST

This function creates new activity statements or updates existing activity statements with data from a Banklink file. Refer to BAS/IAS Import.

Print PDF

A PDF of the Activity Statements is printed for the client or clients you select. The FACS Print job has the Tax Office copy PDF attribute selected. Refer to Print tax form options 2023.

The Lodgment tasks allow you to:

Update agent details

This is the same as the process available on the Lodgment Benchmark homepage (AE) / page (AO). See To update an agent’s details.

Select for ELS Output

This is the same as the process available on the Tax - Client Search homepage (AE) / page (AO). See Lodgment status.

Update status

You can set the status of the activity statement to ‘lodged’ or ‘not lodged’. Activity statements that have passed F3 validation and are ready for lodgment will have a green tick.