Changes to Client Update forms (From 2 August 2021 onwards) 2023

From 2 August 2021, the Client Update forms must be lodged in XML format, and not in the current XBRL format. This will be a backend change in MYOB Tax.

You can still lodge the Client Update forms from AE/AO tax (version 2021.0) with the exception of the following notifications:

You can no longer use:

- the CUREL form for Delete activity statement only

- the CUDTL form for Change of name to non-individual returns only.

CUREL & CUADDR forms

You must complete the ABN and ABN Division number when selecting

- Add activity statement client in the CUREL form

- Address for activity statement purposes in the CUADDR form

If you don't complete these fields, the forms will be rejected with an error. Soon, we'll be implementing the validation tests in tax to check for these fields.

We'll be adding the ABN and ABN Division for individual CU forms in the next tax service pack release, till then lodge any notification of Add activity statement client and Address for activity statement purposes for individuals using the ATO online services for agents.

CUREL (Individual and non-individual)

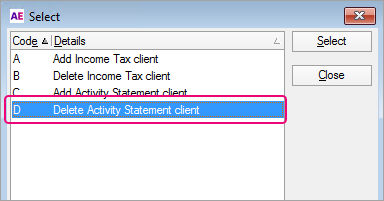

- You can no longer use Code D - Delete Activity statement client. You'll see the rejection error: Notification of Delete Activity Statement Client is no longer available from AE/AO Tax when lodging.

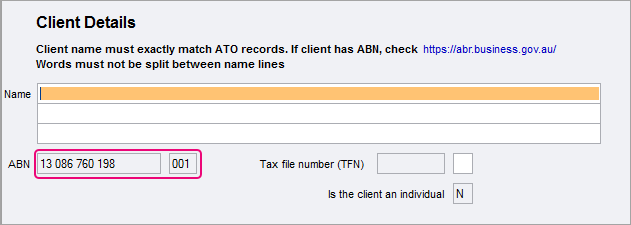

- You must complete the ABN and ABN Division number for non-individual entities.

Without a Division number, you'll see the rejection error: ABN and ABN division number are required. Enter in Return Properties when lodging.

To enter the ABN, go to Return properties > General tab, and enter a value in the ABN and Division No field. (Division No is also known as Branch code, with values 001 to 999).

CUDTL (Individual and non-individual)

- You can lodge this form for an individual taxpayer to notify the date of death.

- The ATO will no longer accept this form for non-individuals to notify the change of name. You'll see the rejection error: Change of organisation name form is no longer available using ATO Client Update forms when lodging.

CUADDR (Individual and non-individual)

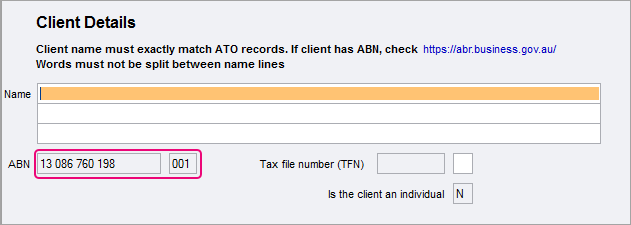

- You must complete the ABN and ABN Division number when notifying a change of address (Address for activity statement purposes)

Without a Division number, you'll see the rejection error: ABN and ABN division number are required. Enter in Return Properties when lodging.

To enter the ABN, go to Return properties > General tab, and enter a value in the ABN and Division No field. (Division No is also known as Branch code, with values 001 to 999).

How to notify the changes to the ATO?

To notify a change of name for non-individuals or remove a relationship at the activity statement level, log in to the ATO's Online services for agents.

There are no changes to the lodgment of: