cuc - Change or advise address for a client - Individuals (PLS CUADDR) 2023

For more information about Client Update Forms see Client Update Forms via PLS 2023.

Although the ATO has named this schedule Change Address, the same form is used for advising the address of a new client for IT or AS purposes.

Therefore, if you are advising the address for a new client, you should NOT lodge the CUADDR until the new client has been added to your IT or AS list by the ATO. The ATO has informed software developers that once the CUREL is lodged, updating their records is instantaneous. Failure to ensure that the client is on the relevant list, will result in your CUADDR being rejected on lodgment.

Updates to your client list lodged via PLS occur in real-time for single transactions, providing there are no errors in the request and the form is validated by the ATO.

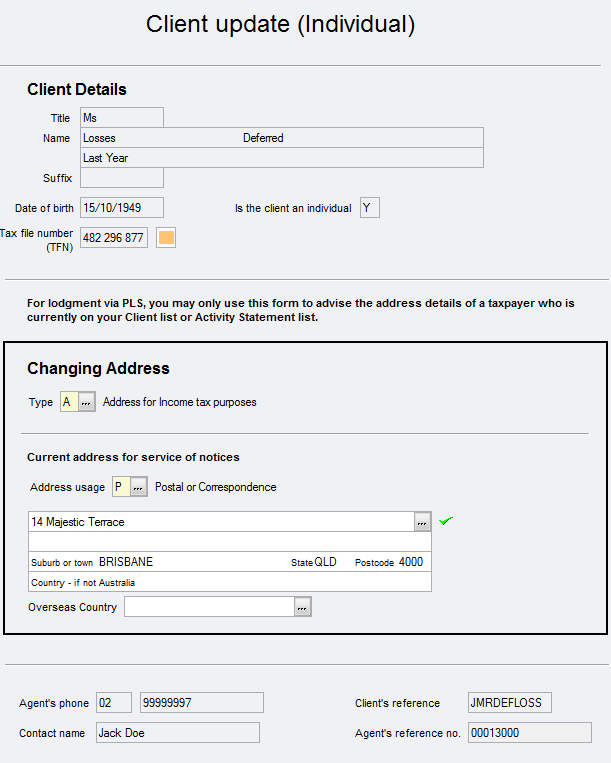

Completing the MYOB cuc (PLS CUADDR) for an individual

This is a multiple schedule.

The CU forms are available from the Preparation > Schedules Index or from the navigation pane under ATO forms when the return is open.