cuf - Change details - Individual (PLS CUDTL) 2023

Updates to your client list lodged via PLS occur in real-time for single transactions, providing there are no errors in the request and the form is validated by the ATO.

For more information about Client Update Forms see Client Update Forms via PLS 2023.

Completing the MYOB cuf (PLS CUDTL) for an individual

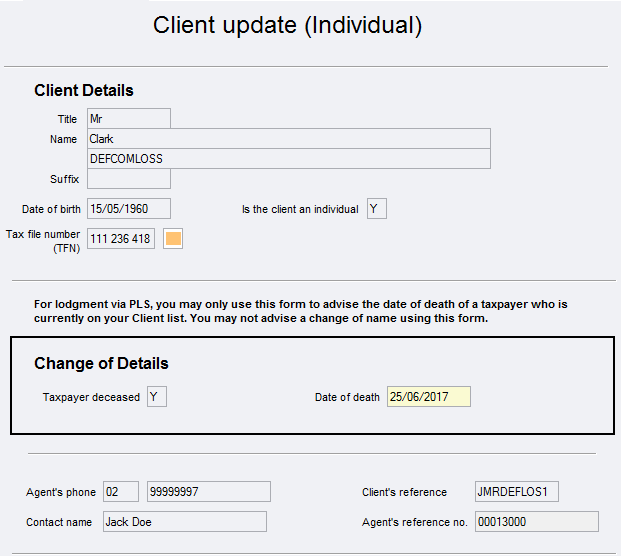

The CUDTL changes apply solely to income tax clients and the only detail you can change for the taxpayer for lodgment via PLS is advising the date of death of a taxpayer currently on your Income Tax client list.

The CU forms are available from the Preparation > Schedules Index or from the navigation pane under ATO forms when the return is open.