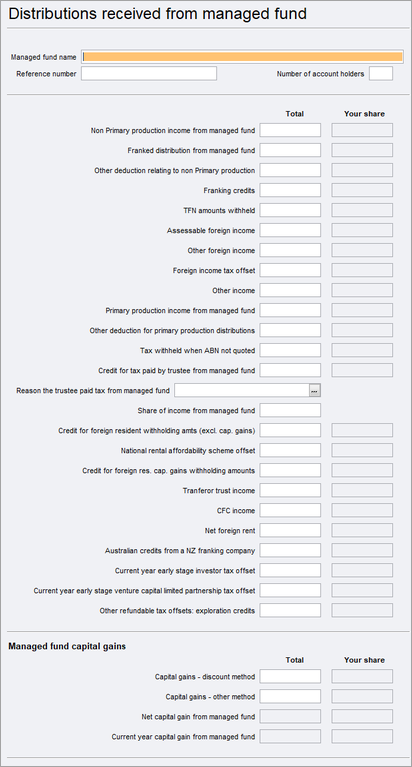

Use the Distributions received from Managed Funds (dim) worksheet if you've received a distribution from a Managed fund.

The dim worksheet was introduced to report only the managed fund distributions. In the previous years, you would've included these amounts in the distribution from trusts worksheet.T

The total amounts in dim worksheets are transferred to the Distributions received from trusts worksheet (dit) 2023 worksheet.

Labels that integrate from the dim worksheet:

Income items Tax offsets Item 18 Label X - Credits for foreign resident capital gains withholding amounts Item 19 Foreign entitiesLabel K - CFC Income Label B - Transferor trust income Item 20Label R - Net Foreign rent Label M - Other Net Foreign Source Income Label F - Australian franking credits from a New Zealand franking company Label O Foreign Income Tax Offset Other Income Item 24V Category 4 Income Item T7- Ealy stage venture capital limited partnershipLabel K - Current year tax offset Item T8 - Early stage investor Item T10 Other refundable tax offsets

We've got a little reminder about Distributions received from Managed Funds (dim) in the Distributions received from Trusts worksheet (dit).

Accessing the dim worksheet

To open the dim worksheet:

Select Preparation > Schedule > Distributions received from Managed Funds (dim) . Go to Preparation > Schedule > Income details schedule > Enter Y at Section N - Managed fund distributions . You can use the ATO Pre-fill to download reports and check what the ATO has received from the managed fund. See What data pre-fills into Tax? 2023