Employee Share Schemes worksheet (emp) 2023

This item is about discounts on employee share scheme interests (ESS interests) that you or your associate received under an employee share scheme.

ESS interests are:

shares

stapled securities (provided at least one of the stapled interests is a share in a company)

rights to acquire shares and stapled securities.

An ESS interest acquired by your associate as regards your employment is treated as though the ESS interest was acquired by you.

The discount is the difference between the market value of the ESS interests and the amount paid to acquire them.

The ESS interests can:

be from an Australian company or a foreign company

relate to your employment inside or outside Australia

relate to a work relationship other than employment, for example sub-contracting.

Changes to employee share schemes took effect on 1 July 2015 and apply to ESS interests acquired on or after that date.

For essential information for Tax Agents on Employee Share Schemes home page click this link to the ATO website.

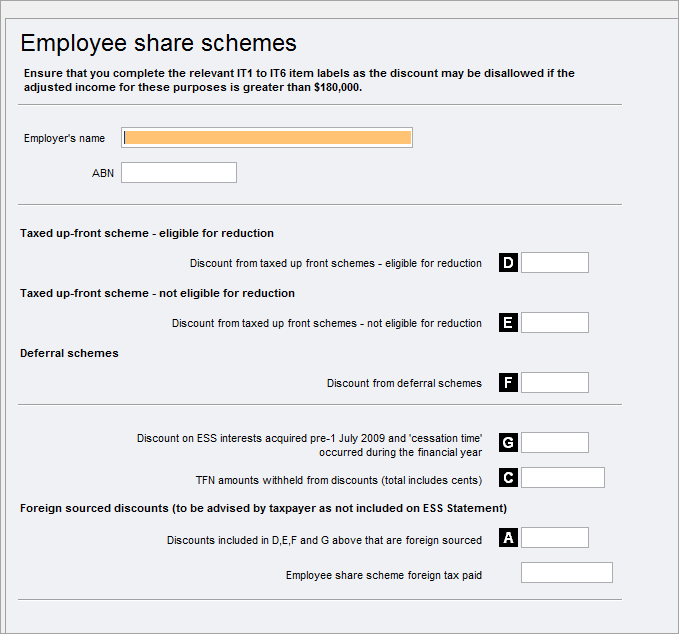

In calculating the income test amount, any reduction to the assessable discount amount due to the $1,000 exemption is to be ignored - that is, the discount amount up to $1,000 should be included in the amount entered at label D. Therefore, you must enter the FULL value of these discounts at label D.

Access to the existing tax exemption of up to $1,000 will be restricted to taxpayers with an adjusted taxable income* (income test amount) no more than $180,000.

For the income test to be satisfied, the sum of the following amounts must not exceed $180,000:

Taxable income (not including the $1,000 reduction)

Reportable employer superannuation contributions

Total reportable fringe benefits amounts

Net financial investment loss

Net rental property loss

Deductible personal superannuation contributions.

If the taxpayer has a taxable loss, this is to be treated as zero for the purposes of calculating the income test amount.

It is important therefore that where your client is in an Employee Share Scheme you check and complete all the items that fill the Income Test item fields at IT1 to IT6.

If the taxpayer satisfies the income test ($180,000) the reduced amount will be included at label B.

The calculation of the Total assessable discount amount label B is automated by Tax with the income test being performed at the same time.

Therefore, the details shown in the worksheet example above, where the taxpayer has Adjusted taxable income exceeding $180,000, the income test is applied during integration and if it is met, the $1,000 discount is not allowed.

Tax Pre-fill

This schedule can be pre-filled using the Pre-fill Manager. The Pre-fill Manager enables you to download pre-fill reports for clients using the Practitioner Lodgment Service (PLS). You can view these reports in PDF format, and populate the pre-fill information into the client's Tax return. For more information on pre-filling, see Pre-fill manager 2023.

Tax Pre-fill is dependant on available ATO data. Validate the Tax return by pressing [F3] for a list of the imported values and any errors before lodgment.