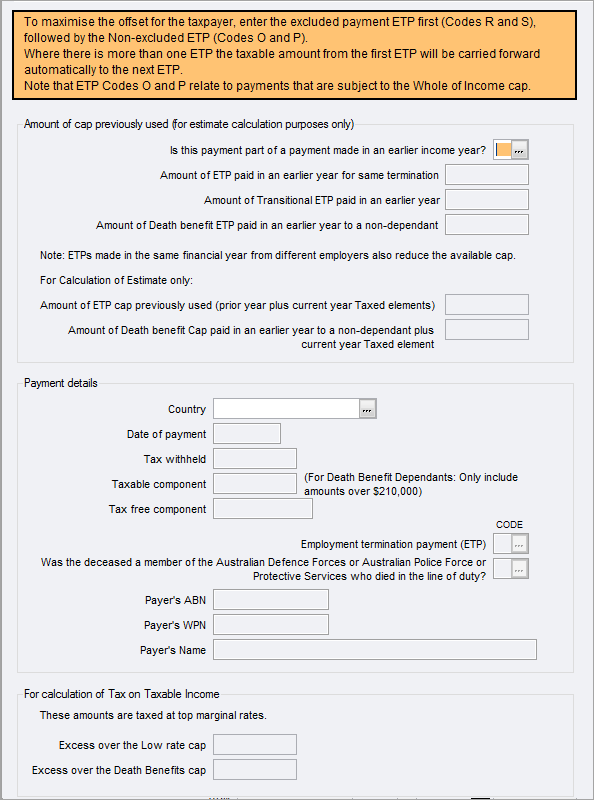

Employment termination payment summary (py) 2023

This schedule collects all the information needed to calculate the ETP offset and to lodge the py with the ATO when you've received more than one ETP payment summary.

If you've received only one ETP payment during the current income year, the ATO only wants to receive the values from the return labels. See Item 4 - Employment termination payments (ETP) 2023.