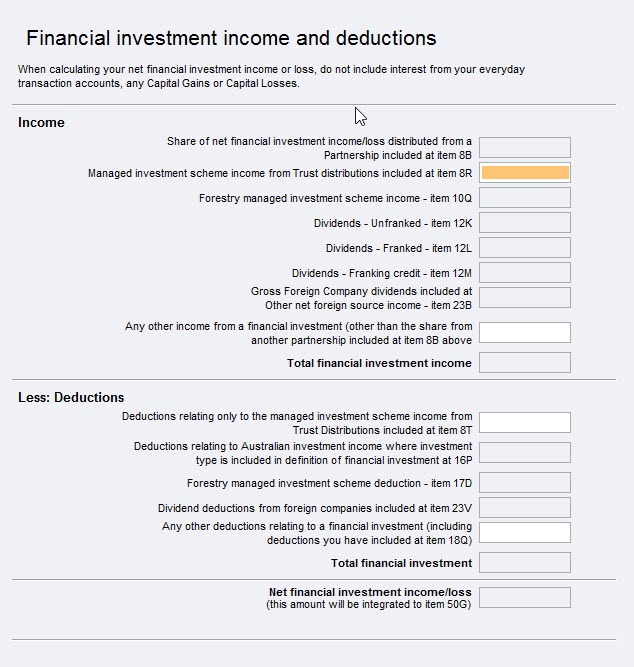

Financial investment income and deductions (fip) 2023

This worksheet will help you meet ATO requirements. Most of it is auto-completed from items and worksheets you've already filled in.

Why does the ATO need this information?

The ATO uses the information to work out each partner's share for income test purposes.

- HELP Loans:

- Student Financial Supplement Scheme repayments

- Student Start-up loan repayments

- ABSTUDY Student Start-up loan repayments

- an individual's Super co-contributions

- Medicare levy surcharge.

The DHS uses income tests to work out the eligibility of Family Tax Benefits (FTB) Parts A or B.

MYOB uses income tests to calculate your client's tax liability when using the F4 estimate.

We pre-fill the amounts entered at:

- item 50: Income tests: label G—Net financial investment income or loss

- item 51: Statement of distribution: label J—Net financial investment income or loss.

You must distribute this amount to the partners in their respective share in the partnership.

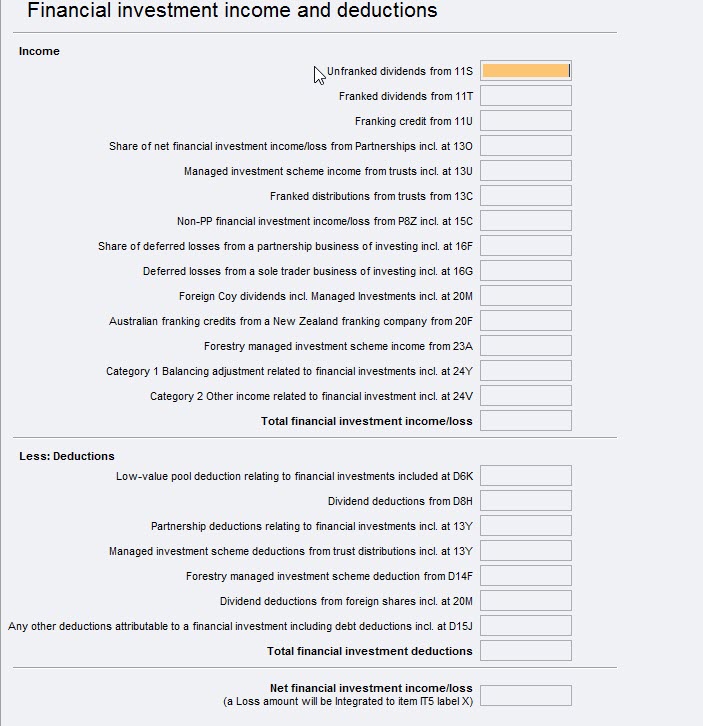

During F8 distribution, we'll:

- Create a Distribution received from partnerships worksheet (dip) in each partner's individual return

- Calculate your client's correct tax liability when you complete their own income tax returns.

If you don't act for one of the partners, their share of income or loss will still be distributed and you'll need to print that partner's xP and ensure that it gets to the partner concerned.

You'll find this worksheet by clicking:

- item 50: Income tests: Label G—Net financial investment Income or loss

- Preparation > Schedules > Financial investment income or Loss (fip).

We'll also create a reciprocal worksheet at Item IT5: Label X—Financial investment income and deductions worksheet (fil) in each partner's individual return.