Foreign income worksheet (for) 2023

To open the Transaction dialog to enter Foreign income transactions, click the Worksheet button or press [Alt+W] to open the Foreign Income worksheet.

This dialog box contains tabs for Other foreign income and Trans-Tasman transactions, and a Summary tab.

These are transactional dialogs used when there is more than one entry of the same type to be made.

The Other Foreign Income transactions amounts are totalled and declared as income and where foreign income tax has been paid on any transaction, those transactions are used in the calculation of the foreign income tax offset.

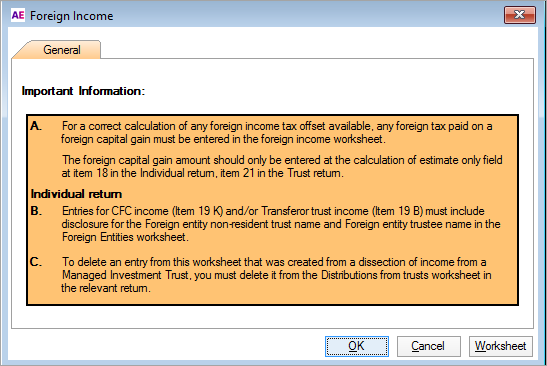

Where the taxpayer has a foreign Capital gain which must be disclosed at Item 18, for the calculation of the foreign income tax offset (FITO) to be correct, a special field has been provided at the capital gains item to enter the amount of the foreign capital gain.

Important Note on foreign capital gains:

If any tax has been paid on the amount of foreign gain you have entered in this special calculation only field at the capital gains item, you must create am entry in the foreign income worksheet to record the amount of tax paid (if any) on this Capital gain. Failure to do this will result in an incorrect calculation and the offset.

The Trans-Tasman provides for the calculation of Australian franking credits from a New Zealand company.

Unlike Tax, all Foreign income is entered in this dialog – Foreign Salary and Wages, Foreign Pensions, Attributable foreign income and all other Foreign source income.

Information recorded for each foreign income transaction:

| Field | Description |

|---|---|

| Description | Enter a brief description of the transaction |

| Type of Income | This is required for integration purposes as entries in the foreign income dialog can be generated from other items in the return. For example, the Distributions dialog which allows foreign income transactions to be entered at the same time as the other income and credits received from the MIF. |

| Foreign Country code | Press [F10] for the available foreign currency codes. Select the method of conversion and the Australian Dollar amount will be calculated. |

| Exchange rate method | Select from the Exchange rate method to be used: Actual, Average or Year End |

| Foreign Currency | Enter the amount in the foreign currency for the transaction grossed up by the foreign tax paid. For example, an income amount of USD$2000 on which foreign tax of USD200 has been paid is entered as 2200. Do not include any amounts of Exempt Foreign Employment Income or Foreign Capital Gains as transactions. Enter Exempt foreign employment income in the front entry screen. and create a transaction for any foreign tax paid on a Foreign Capital Gain included in Net Capital Gains. |

| Exchange rate | If you have selected a foreign currency, the relevant exchange rate will pre-fill this field. Otherwise enter the exchange rate for the currency to Australian dollars (AUD) for the particular foreign currency. The amount entered will be calculated and displayed in the Australian $ field. |

| Reasonably related deductions | From the total deduction for the transaction enter in this field the amount that can be said to be reasonably related to the income. This breakdown is required for the correct calculation of the FITO limit (the cap). Whether a deduction reasonably relates to the disregarded amounts will be a question of fact depending on the circumstances of the taxpayer. Expenses that relate exclusively to the disregarded income amounts will be ignored in calculating the second element of the cap calculation. Deductions that relate to both the disregarded income amounts and other assessable income will need to be apportioned on a reasonable basis between the different income amounts. Refer to Schedule 1, item 1, subparagraph 770-75(4)(b)(ii) of the ITAA 1997. Allowable deductions for items such as debt deductions (these should be entered at D15 for the individual return and the relevant item expense label in the other form types), gifts, contributions, superannuation and tax agent's fees (these should be entered at the relevant expense item in the relevant return) are not considered to be reasonably related amounts. |

| Net amount | This is the result of the Income amount less the Reasonably related deduction amounts, and is calculated by the system |

| Eligible foreign tax paid | Only that amount of the foreign tax paid that relates to eligible foreign income should be entered at this field. |

The system does not calculate the Foreign income tax offset at this point but does so only when you click [F4] after saving and exiting the worksheet. The FITO cap can only be calculated when all the income and deductions for the return have been processed. Therefore the user controls at what stage the return is complete and the estimate is to be prepared. Each time you change the Taxable Income or loss in the return, you will need to press [F4] so that the FITO cap and the offset can be recalculated using the revised figures.