IT3 Tax-free Government pensions worksheet (tgp) 2023

The income entered in this worksheet is used in calculating the taxpayers Adjusted Taxable Income (ATI) for dependency offset eligibility.

Tax-free government pensions are pensions which you do not need to pay tax on. However, they are taken into account when calculating your adjusted taxable income for eligibility to certain tax offsets.

In order that pre-filling of the spouse details labels in the taxpayer's return may be completed correctly so that no overstating of the spouse's ATI occurs, the worksheet is in two sections.

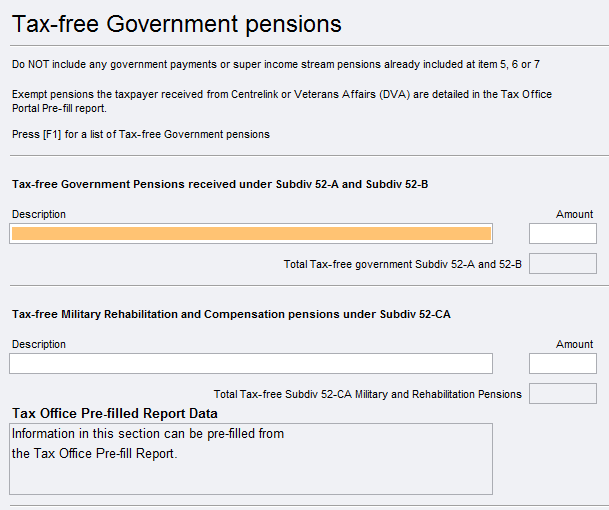

The first section is for tax-free Government pensions under Sub-division 52-A Subdivision 52-A (Social Security Act 1991 pensions) or 52-B (Veterans' Entitlements Act 1986 pensions). These are the payments that if they were not tax-free would be entered at item 6 Australian government pensions and allowances. These pensions, although exempt, are used in the calculation of the transfer of the unused portion of the pension offset to spouse.

The second section is for tax-free pensions paid under Sub-division 52-CA (Military Rehabilitation and Compensation Act 2004). Some of these are:

a Special Rate Disability Pension under Part 6 of Chapter 4 of the Military Rehabilitation and Compensation Act 2004;

a payment of compensation under section 68, 71 or 75 of the Military Rehabilitation and Compensation Act 2004;

a payment of compensation mentioned in paragraph 234(1)(b) of the Military Rehabilitation and Compensation Act 2004.

For essential information about IT3 click this link to the ATO website.

You can also find a list of Tax free government pensions in the Individual tax return instructions on the ATO website Exempt income as well as those detailed from the Military Rehabilitation and Compensation Act 2004:

To insert additional sets of fields, click Ctrl+Insert.

Tax Pre-fill

This schedule can be pre-filled using the Pre-fill Manager. See Pre-fill manager 2023.