Loss Carry Back Change in Choice (cic) — (Amended Company returns only) 2023

Key points

- An eligible corporate entity may change a loss carry back choice for the 2020–21 and 2021–22 income year. Change in choice is effective from the day the entity made the original loss carry back choice.

- The Loss Carry Back Change in Choice (cic) is available in 2021 and 2022 and only when you amend a company tax return.

- If you need to make any changes to Item 13 in a tax return, then you must complete the Loss Carry Back Change in Choice (cic) schedule.

- This is a lodgable schedule with the ATO.

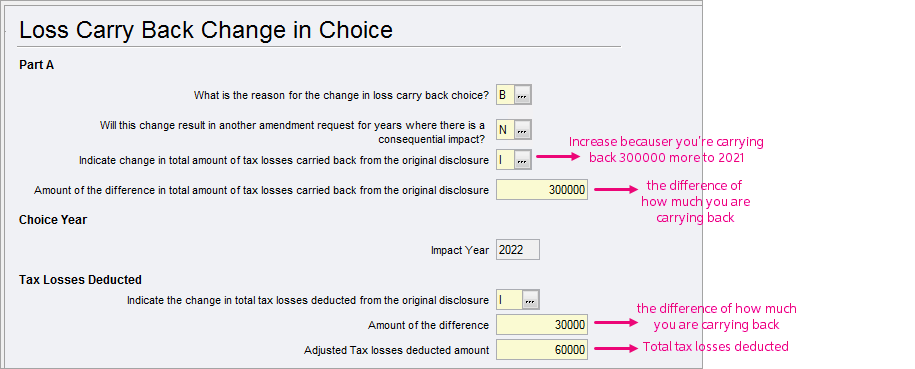

In MYOB Tax, we've added a new worksheet called Loss Carry Back Change in Choice (cic) to change any loss carry back amounts in the previous years.

The Loss Carry Back Change in Choice (cic) worksheet will be available only on Amended Company returns

The Loss Carry Back Change in Choice has the following sections:

MYOB INTERNAL STAFF ONLY