Partnership distribution (xP) 2023

Each partner is identified by a worksheet (the xP) which provides all the partner's details and which rolls over from year to year.

If the partner’s profile does not change from one year to the next, then all that is required once data entry has been completed is to press F8 or navigate to Item 51 and click Distribute. We'll distribute the various income types and their respective credits in accordance with the Partnership percentage entered in each xP.

To open the xP, at the box beside the Distribute icon press Enter. To add additional xPs click New from the Index.

Partner Worksheet

The details entered identify the partner as either an individual or entity. The required details are:

| Detail | Description |

|---|---|

| Name | Each partner must be named and must receive at least a distribution of PP income or non-PP income, or an amount of franking credit or a TFN amount. For each partner, either the family name or entity name must be entered. Returns rolled over from the prior year carry forward all the partners’ details. You must ensure that those details are still current. |

| TFN | You must provide each partner's tax file number and the current postal address of each partner. |

| ABN | The ABN must be provide for a Corporate partner. |

| Date of birth | This is required for individual partners. |

| Partner 18 years or older | This is included here to make it easier when lodging via PLS. |

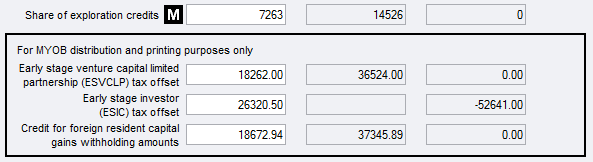

| Distribution percentage | Enter the percentage share the partner holds in the partnership. All income/loss, offset, credits, and so on will be distributed to the partner in that percentage. Amounts distributed are share of:

|

For distribution and record keeping purposes only:

Distribute Option

Press F6 to save and close the xP.

Press F8 to distribute the income in accordance with the partner’s share in the partnership. You may also click the Distribute button at Item 51 or the Icon in the header bar.

You can press F8 from wherever the cursor is in the main return; you don't have to be at the Distribution statement item to re-distribute.

If the income, deductions or any offsets and credits are changed after F8 distribution, you must press F8 again for those changes to be tallied up and included in the Unders and Overs column and so be available for distribution.

F3 validation alerts you to any anomalies or errors that you should fix before lodging the Partnership return.

If you act for all the Partners, then you should lodge the Partners' individual returns at the same time, Otherwise lodge the individual Partner returns of those you do act for.