Prefill - Other Income (Category 3) (pov) 2023

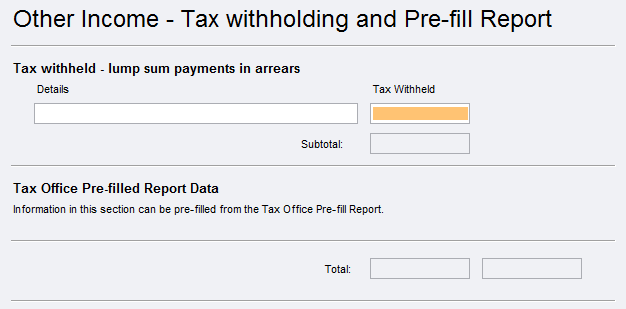

This worksheet (pov) can only be generated by pre-fill – it contains no editable fields. If the tax payer has government payments or trust distributions which are category 3 income, this information will be populated in the worksheet. SeePre-fill manager 2023 for more information.

The pre-fill values are:

- Other Income code

- Payment type – a description of the payment type

- Allowance amount – the value for the government payment amount, during the relevant period

- Exempt amount – an existing column in the CSV pre-fill. Refer to Australian Government special payments (eps) 2023.

- Tax withheld – an existing column in the CSV pre-fill. Refer to Australian Government special payments (eps) 2023 .

- Taxable income – an existing column in the CSV pre-fill. Refer to Australian Government special payments (eps) 2023 .

If you would prefer not to use the pre-filled data, delete the worksheet. See Deleting Schedules 2023 for more information.

Tax Pre-fill is dependent on available ATO data. Validate the Tax return by pressing F3 for a list of the imported values and any errors before completion and lodging.