Section A: SMSF Fund details 2023

This help section covers all fund and auditor details requirements.

For information about where integrated data is sourced from, see Names and addresses in tax returns 2023.

We default the TFN from Return properties. If the TFN is not valid, an error will occur on F3 validation.

If the client and return have been set up correctly, the following information will default into the relevant fields in a newly created return:

- All front cover names and addresses

- All back-page Tax Agent Declaration details, as entered in the Control Record for the relevant Agent.

If the fund name is legally changed, you must advise the ATO of the change by either updating it online at www.abr.gov.au or completing the Change of details for superannuation entities (NAT 3036) at the time the change is made.

See Names and addresses in tax returns 2023.

The ATO strongly encourages Funds without ABNs to apply for an one online at www.abr.gov.au or lodge the Application for ABN registration for superannuation entities (NAT 2944).

The ABN entered must be valid. If it is not, an error will occur on F3 validation.

This address will be used for the issuing of any assessments raised from this return and other correspondence.

Is this an amendment to the SMSF’s 2019 return?

Amendments to the annual return may be prepared and lodged electronically by selecting Preparation > Amend and following the prompts. Refer to Amending Lodged Returns 2023.

Is this the first required return for a newly registered SMSF?

The response to this question defaults to No. On F3 validation a warning may display advising you to check this response, if:

- The Date of establishment/incorporation on the Return Properties PAYG/Lodge tab for this return shows the SMSF has been registered within the last 18 months, and

- The response to the above question is No.

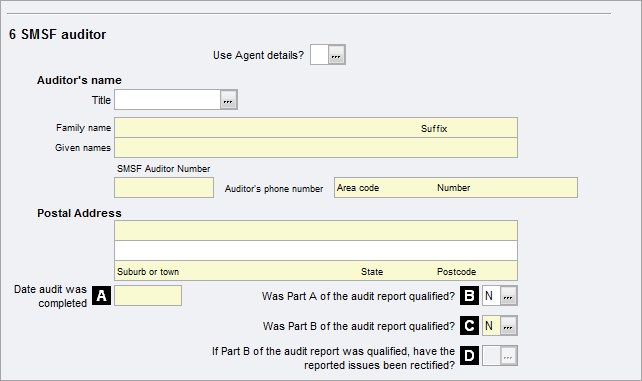

From 1 July 2012, Approved Auditors of SMSFs can register with the Australian Securities and investments Commission (ASIC).

From 1 July 2013, Approved Auditors must register with ASIC to be able to conduct audits of SMSFs.

ASIC maintains a public register of Approved Auditors who are registered with them. You can check whether your auditor is registered and search for a registered auditor by visiting the ASIC website.

You should check that your auditor is registered with ASIC each year before engaging the auditor to complete your annual audit.

SMSF Auditor Number (SAN)

ASIC issues a registration number to Approved Auditors who register with them. You must enter the approved auditor's registration number in the field provided.

All self-managed superannuation funds must undergo audit every year. You must have this audit conducted prior to lodging the SMSF.

The label B definition has changed to cover Part A of the audit report and label C now covers Part B of that report.

Label D is new and is only required to be answered when either Part A or Part B of the audit report was qualified.

If the answer at label B or C is Yes, you must provide an answer at label D. Type Y or N or select Yes or No from the drop-down list.

For information on auditing standards and independence, refer to the standards of your professional association as well as considering the Auditing Standard issued by the Auditing and Assurance Standards Board at www.apesb.org.au.

Use Agent’s details?

Select Y at this question to pre-fill the auditor details recorded on the Agent's Control record or the Return properties Staff 2023 tab . See Names/Audit 2023

You must complete the bank details each year as those provided in a previous year aren't retained when the return is rolled over.

This consists of three parts, A, B and C:

There are two sets of fields provided for Bank details A and B.

C is to advise the Electronic service address (ESA).

The ATO advises that many SMSFs are lodged with incorrect banking details. You'll see from the following screenshot that changes to the wording are numerous.

Label A is mandatory and must be the Fund's account with a financial institution and not the Agent's Trust account.

Label B is where you enter the Practice's or Agent's trust account details. If you fail to enter details at label B, the ATO will pay all income tax refunds into the account at label A.

You may select pre-recorded bank details for the SMSF or for the Agent’s trust account where the refund will be paid directly to the Trust account.

You can store up to two sets of bank account details for the SMSF in the Return Properties > Bank A/cs tab. See Bank a/cs 2023.

At the prompt Select bank a/c details from, click the ellipsis and select the relevant bank account.

If all moneys for the Fund from either the ATO by way of superannuation payments or from tax refunds go to the same account, then don't complete label B.

If the Fund has separate account, then select those details from Agent's record. Select Utilities > Control Record > Banking tab. See Setting up your Control Record Properties for Banking 2023.

Alternatively, enter the details directly into the fields provided at this item:

For the current and future income years, the ATO has extended the length of both name fields so that up to 200 characters may be entered.

To edit these details:

–If all 200 characters are present, then you will need to delete some before you can change anything.

To move across the row, click into the second field and use the right arrow to progress to the end.

The first 70 odd characters display on line 1 and the remainder on line 2.

C - Electronic Service address alias

SMSFs that receive employer contributions (other than from an employer that is a related-party) are required to have an electronic service address (ESA) obtained from a registered service provider to enable electronic remittances to be sent when employers make super contribution payments. The ESA will also be used by the ATO to inform you of any super payments made to the SMSF by the ATO.

Enter at C your electronic service address alias. The ATO will use it to send electronic remittances of ATO super payments that it makes to your SMSF.

An ESA is not an email address, not is it of the SMSF or the contact details of the SMSF messaging provider.

If your SMSF does not have an ESA, you will be sent a manual remittance about any super payments made to your SMSF.

For more information about getting an electronic service address, see SMSF messaging providers.

If the SMSF does not meet the definition of Australian super fund at any time during the income year, the SMSF is NOT a complying SMSF and won't receive the concessional rate of tax of 15%. It will instead pay tax at the top marginal rate of 45%

If you are the trustee of an SMSF and you are planning on going overseas, we suggest that you consider whether your SMSF will still be an Australian super fund.

Answer the question yes or no as appropriate.

If the trustees have:

- lodged all applicable returns,

- paid all outstanding debts,

- paid out (or transferred) all member benefits and cancelled the fund's ABN (if applicable) either via www.abr.gov.au or lodging a Registration, cancellation or change of details (NAT 2955-07.2007) form,

Select Yes to this question.

The date of winding up the fund must be in the current income year or substituted accounting period.

For an SMSF wound up during the current year, you must complete M Supervisory levy adjustment for wound up funds at section D.

See Exempt current pension income on the ATO website.

Did the fund pay an income stream to one or more members in the income year?:

A ‘Yes’ response to this question will require other labels at item 10 to be completed.

A ‘No’ response will move focus to the first Income label.

We've provided a grid at this label for dissection of the amount.