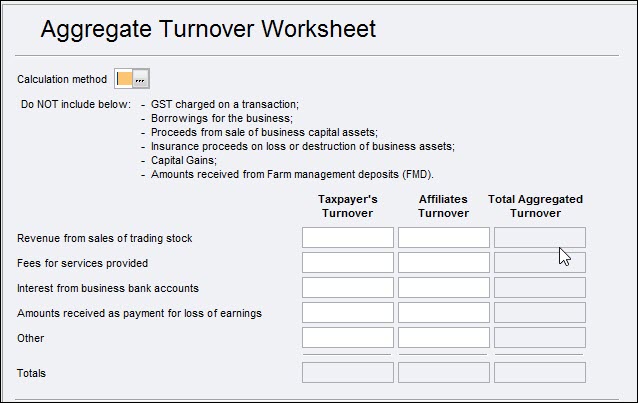

Small business entity aggregated group turnover worksheet (sat) 2023

Forms affected I, P, T and C

This worksheet (sat) is provided to assist with calculating the taxpayer's aggregated turnover.

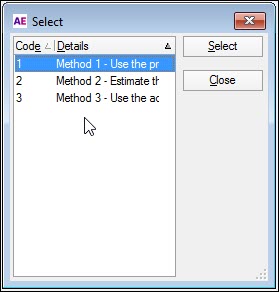

If you can't see the full details in the Calculation method window, drag from the right hand side corner to expand.

Calculating aggregated turnover

In addition to an entity’s annual turnover, it must include the annual turnover of any entities that are affiliates or connected with the entity (such affiliates are 'relevant entities') at any time during the income year (with some exclusions).

Therefore, for an entity to calculate its aggregated turnover, it must:

calculate its annual turnover,

apply the aggregation rules, and

calculate its aggregated turnover.

Exclusions from aggregated turnover

The various exclusions relating to aggregated turnover ensure that there is no double counting of income between entities that are required to be aggregated.

Broadly, amounts excluded from aggregated turnover include ordinary income derived:

between dealings with the entity and a relevant entity while they were connected with or an affiliate of the entity,

by a relevant entity from a dealing with another relevant entity while they were connected with or an affiliate of the entity, and

by a relevant entity while the relevant entity was not connected with or an affiliate of the entity.

For information on exclusions click this link to the Small business entity concession home page on the ATO website.