Trust income schedule (DISTBENTRT) and Distributions received from trusts (dit) 2024

In 2024 as part of Modernising trust administration systems, the ATO has introduced a Trust income schedule. This will assist with the correct income reporting and consistency across all beneficiary types required to lodge their tax return.

The Trust income schedule layout is different depending on the return type.

Individual return: The Distributions received from trust (dit) worksheet has been modified to include all the fields required to complete the Trust income schedule.

Company, Partnership ,Trust, Fund and SMSF: A new schedule called Trust income schedule(DISTBEN) has been included.

In 2024 as part of Modernising trust administration systems, the ATO has introduced a Trust income schedule. This will assist with the correct income reporting and consistency across all beneficiary types required to lodge their tax return.

This worksheet records:

the details of any share of income or loss received from another trust

deductions your trust may have incurred in earning that distribution income.

Don't include deductions related to running your own trust.

Consolidation of the records

You can have a maximum of 30 records of the dit worksheet – including any consolidated records. For more than 30 records, consolidate and total the rest into the 30th records.

When consolidating the records, use Consolidation - XX non-managed funds records (with XX being the number of distributions consolidated into the last record) as the description of the record.

We’re working on the consolidation of records which will be addressed in a future release.

What are the changes in MYOB Tax?

In a Trust return, when you distribute the income to the beneficiaries (Individual, Trust, Partnership, Fund or SMSF), it will integrate into the Trust income schedule in the other return type. This income is then integrated into the main return.

You'll find the worksheet by clicking:

Partnership or Trust: item 8: labels A, B or R—Primary production, Non-primary production or Franked distributions from trusts

Company: income item 6: label E—Gross distributions from trusts

Individual return

In an individual return, there is no separate Trust income schedule but we’ve added the new fields to the Distributions from Trust (dit) worksheet that is required for the Trust income schedule reporting. These amounts are then integrated into the main return.

You can access this worksheet from item 13: labels L, U or C—Primary Production, Non-primary production of Franked dividends

The table shows the new labels added to the Distribution statement (xT) in the Trust return, Distributions received from trusts (dit) and how integrated into the tax return labels in the individual tax return.

Distribution statement (xT) labels (Trust return) | Distributions received from trusts (dit) worksheet labels | Individual tax return labels |

|---|---|---|

|

| - |

|

| Reported to ATO via the Income details schedule |

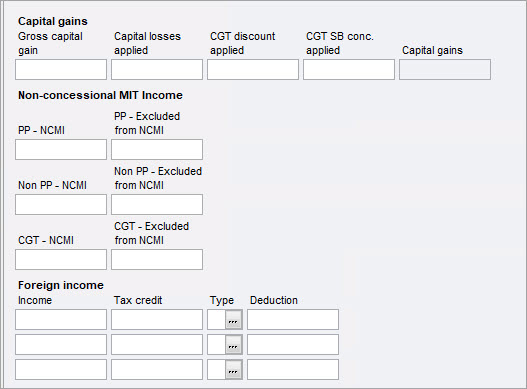

Capital Gains

| Capital Gains

| Creates a capital gains worksheet (g) and then integrates it into the individual tax return labels.

|

Non-concessional MIT Income

| Non-concessional MIT Income

| Reported to ATO via the Income details schedule |

| Foreign Income

| Creates a foreign income worksheet (for) and then integrates it in the individual tax return labels.

|

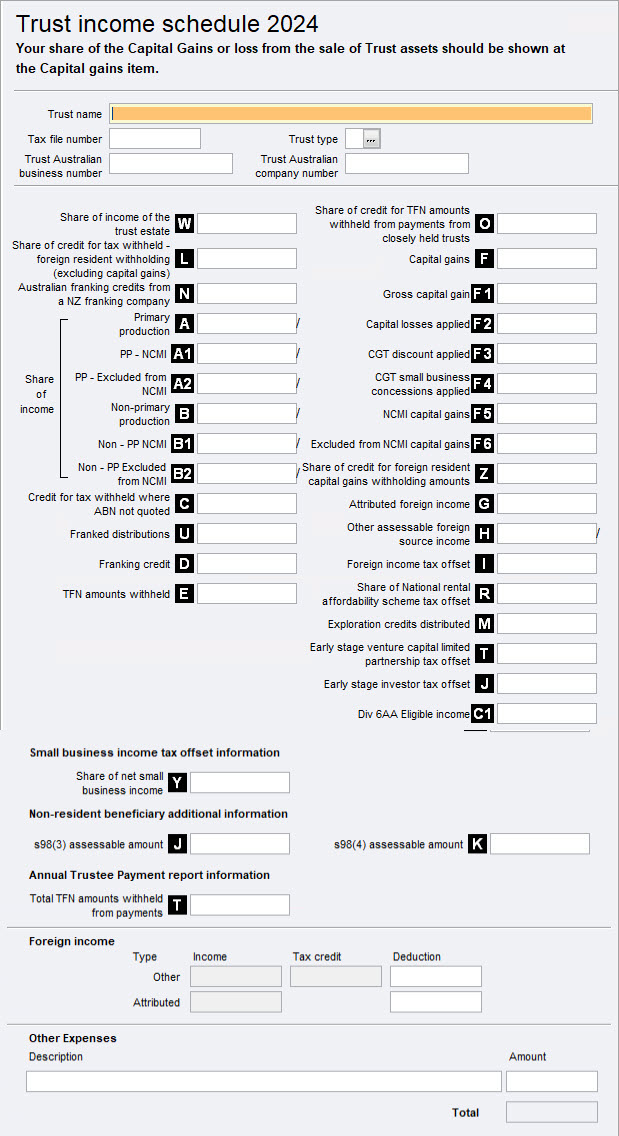

Company, Trust,Partnership, Fund and SMSF returns

In Company trust and partnership returns, the schedule is Trust Income schedule (DISTBNETRT). The fields in DISTBNE are very similar to the Beneficiary distributions in a Trust return.

You'll find the worksheet by clicking:

Partnership or Trust: Item 8: labels A, B or R—Primary production, Non-primary production or Franked distributions from trusts

Company: income Item 6: label E—Gross distributions from trusts

SMSF : Item 11 Label M - Gross Trust distributions

Fund: Item 10 Labels N, O, P or Q - Trust distributions unfranked amounts, Trust distributions franked amount, Trust distributions franking credits or Trust distributions other amounts

Distribution statement (xT) labels | Distributions received from trusts worksheet labels | Company | Fund | SMSF | Trust | Partnership |

|---|---|---|---|---|---|---|

|

| - | ||||

|

| - | ||||

Capital Gains

| Capital Gains

| Creates a capital gains worksheet (g) and then integrates it in the tax return labels. Item 7 Label A - Net capital gain | Creates a capital gains worksheet (g) and then integrates it in the tax return labels. Item 10 Label A - Net capital Gain | Creates a capital gains worksheet (g) and then integrates it in the tax return labels. Item 11 Label A - Net capital Gain | Creates a capital gains worksheet (g) and then integrates it in the tax return labels. Item 21 Label A - Net Captial gain. The Gross Capital gain and CGT discount applied amounts will integrate. | |

Non-concessional MIT Income

| Non-concessional MIT Income

| Reported to the ATO | Reported to the ATO | Reported to the ATO | Reported to the ATO | Reported to the ATO |

| Foreign Income

| Creates a foreign income worksheet (for) and then integrates it into the tax return labels.

| Creates a foreign income worksheet (for) and then integrates it into the tax return labels.

| Creates a foreign income worksheet (for) and then integrates it into the tax return labels.

| Creates a foreign income worksheet (for) and then integrates it into the tax return labels.

| Creates a foreign income worksheet (for) and then integrates it into the tax return labels.

|