Distributions received from trusts worksheet (dit)

This worksheet records:

- the details of any share of income or loss received from another trust

- deductions your trust may have incurred in earning that distribution income.

Don't include deductions related to running your own trust.

You can have up to 99 dit worksheets for any return.

What do I need?

You'll need the statements of distribution from:

- each of the distributing family or discretionary trusts

- each of the managed investment trusts (MITs) or unit trusts (UTs).

What will MYOB Tax do?

We'll create the dit worksheet in the relevant return if you:

- act for the distributing trust

- have used F8 or clicked Distribute at item 55: Statement of distribution to distribute the net trust income:

You'll find the worksheet by clicking:

- Individual: item 13: labels L, U or C—Primary Production, Non-primary production of Franked dividends

- Partnership or Trust: item 8: labels A, B or R—Primary production, Non-primary production or Franked distributions from trusts

- Company: income item 6: label E—Gross distributions from trusts

- If you don't act for the distributing trust, create a dit to record distributions received from other trusts.

- If the distribution is from a Managed investment trust (MIT), enter data from the MIT.

- Use the Pre-fill Manager for your individual clients receiving a share of income from a MIT. See Pre-fill manager.

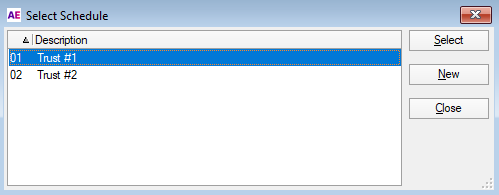

- You can create up to 99 dit worksheets for any return. When more than one exists, each of their names will show in the Select Schedule index of the worksheet.

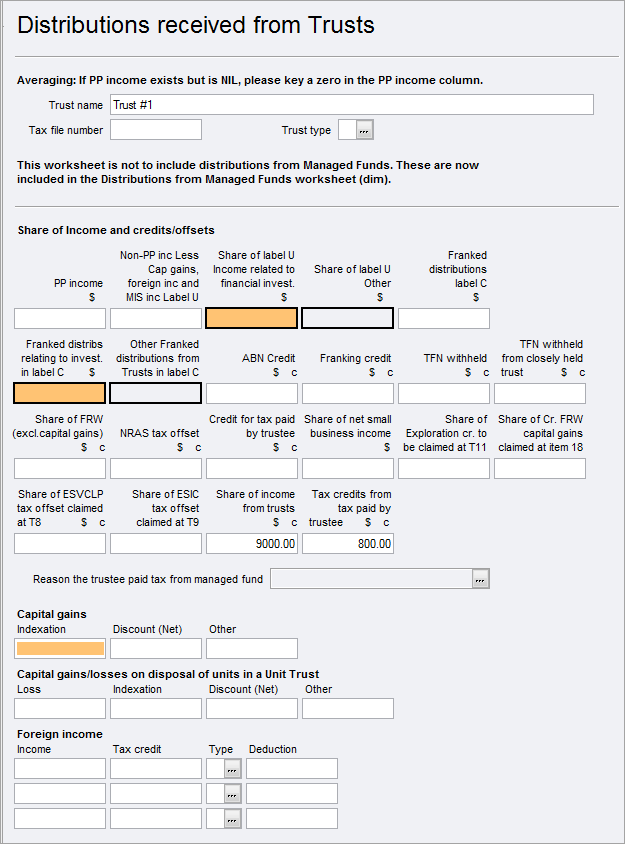

- There are variations to the layout for the dit because different rules and item labels apply to some form types.

- The dit attached to the individual return is the most complex and it's shown in detail below.

For partnership and trust returns only:

We've provided a Quick access link in the dit to the Foreign income worksheet (for).

We'll use the information in the for worksheet to calculate each beneficiary's share of the foreign income tax offset (FITO).