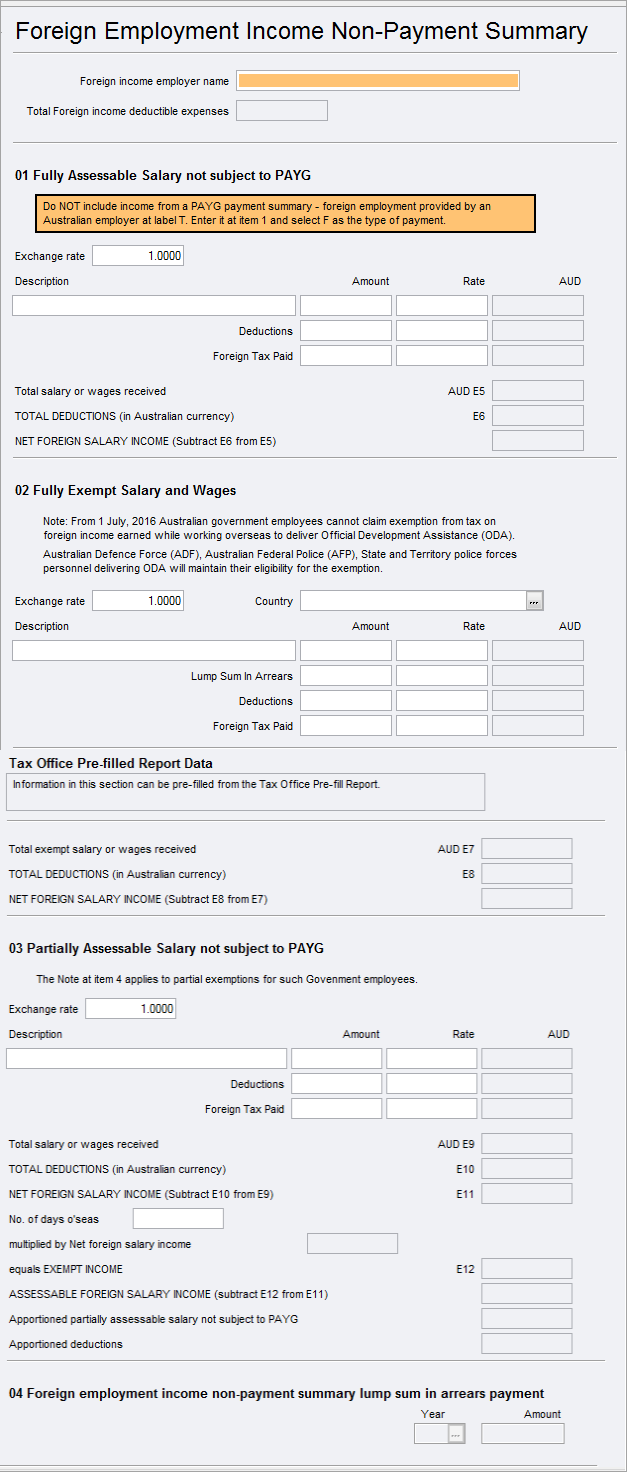

Foreign employment income Non-Payment Summary (fem)

To enter data at Item 20 Label L and D, use the Foreign pensions and annuities (fpa) worksheet.

Complete the Foreign Employment Income Non-Payment Summary (fem) to enter data at Item 20 - Foreign source income and foreign assets or property.