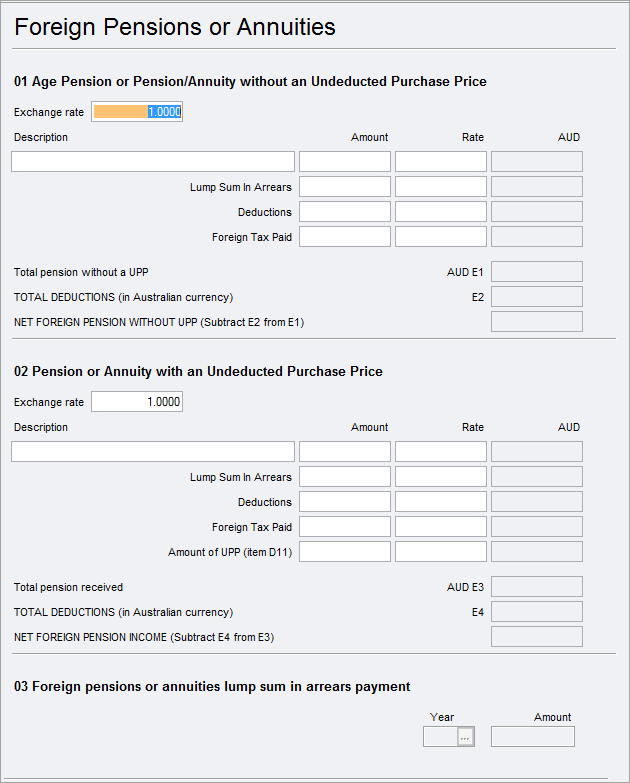

Foreign pensions and annuities (fpa)

To enter data at Item 20 Label T Other net foreign employment income, use the Foreign employment income Non-Payment Summary (fem) worksheet.

ATO has decommissioned the Overseas pensions and salary income worksheet (ove) and replaced it with Foreign pensions and annuities (fpa).

This worksheet is to report details of non-resident trusts distributing the CFC/Transferor trust income.

Complete the Foreign pensions and annuities (fpa) to enter data at:

Item 20 Label L Net foreign pension or annuity income WITHOUT an undeducted purchase price or

Item 20 Label D Net foreign pension or annuity income WITH an undeducted purchase price