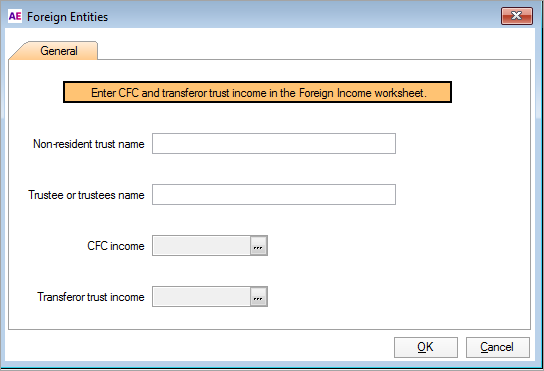

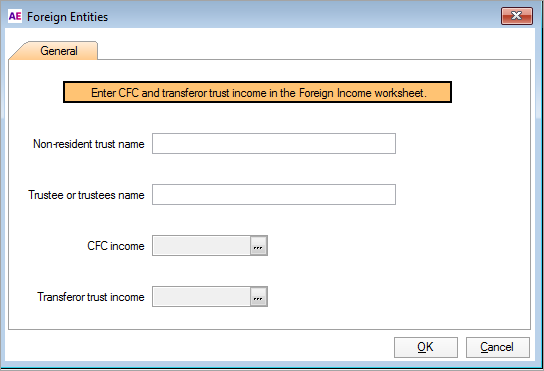

Foreign entities (fen)

Complete the Foreign entities (fen) to enter data at Item 19 - Foreign entities. This worksheet is to report details of non-resident trusts distributing the CFC/Transferor trust income.

Complete the Foreign entities (fen) to enter data at Item 19 - Foreign entities. This worksheet is to report details of non-resident trusts distributing the CFC/Transferor trust income.