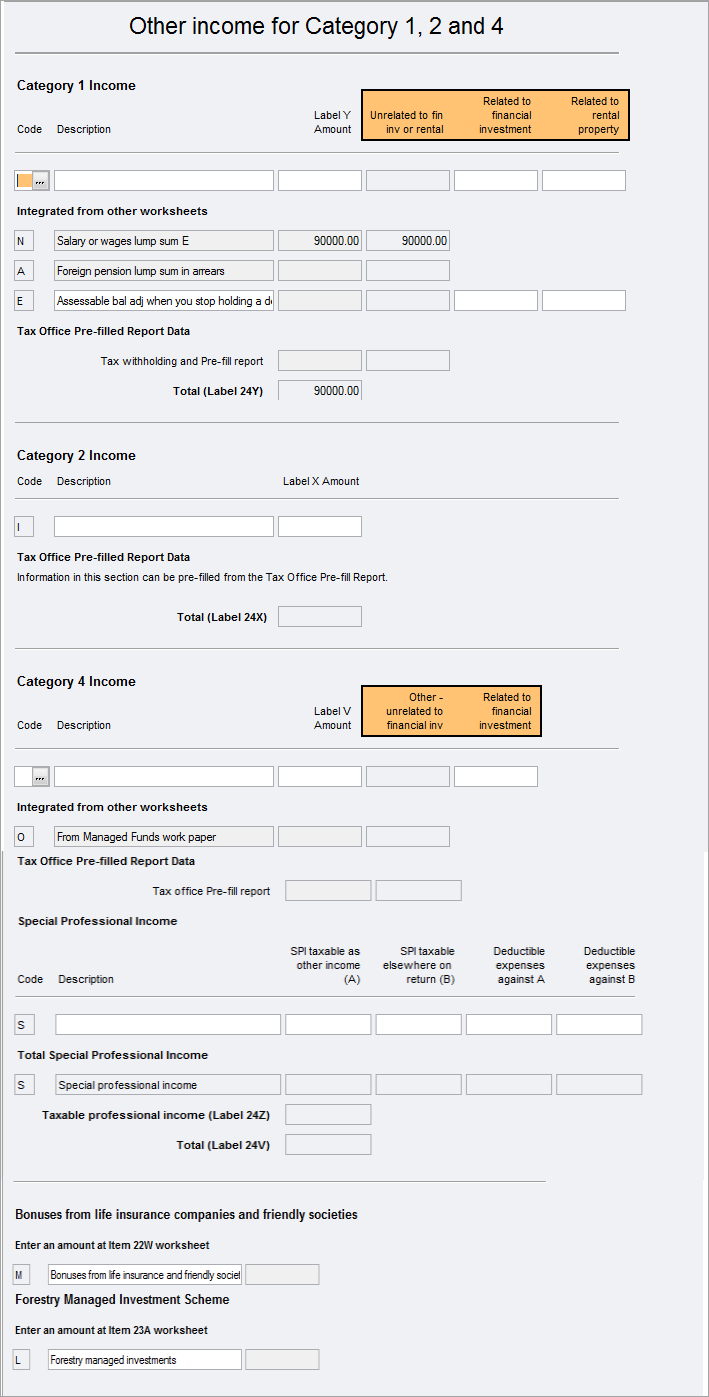

Other Income - Category 1, 2 and 4 (oix)

The ATO has decommissioned the Other income - Category 1 worksheet (oiy) and Other income - Category 4 worksheet (oiv) worksheets and has merged it with the newly revised worksheet Other Income - Category 1, 2 and 4 (oix).

Data in the 5 sections of this worksheet is integrated from other worksheets in the return:

| oix worksheet sections | Integrated from worksheets | Main return label |

|---|---|---|

| Category 1 Income | Item 24 Label Y | |

| Category 2 Income | NA | Item 24 Label X |

| Category 4 Income | Distributions received from Managed Funds (dim) | Item 24 Label V |

| Special professional income | NA | Item 24 - Other Income |

| Bonuses from life insurance companies and friendly societies | Bonus Offsets | Item 22 - Bonuses from Life Insurance Companies and Friendly Societies |

| Forestry Managed Investment Scheme | Forestry managed investment scheme worksheet (fms) | Item 23 - Forestry managed investment scheme income |