IR Schedules New Zealand interest

Did you receive any New Zealand interest between 1 April 2018 and 31 March 2019 from:

banks

Inland Revenue

building and investment societies

credit unions

securities

a partnership, look-through company, estate or trust

loans you’ve made?

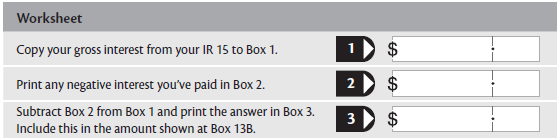

If so, show all the New Zealand interest you received at Question 13B. If the interest is from a partnership, look-through company, estate or trust please tick Box 13C.

If you were charged commission on any of your interest, claim this at Question 26. Read the note about expenses at IR Schedules Other expenses and deductions.