IR7 Example 2 LTC loss limitation rule — current year non-allowable deductions only

IRD number | 12–345–678 |

Total gross income | $6,000 |

Expenses/deductions | $10,000 |

Loss | $4,000 |

One owner (shareholder): | Sam (100%) |

IRD number | 91–111–213 |

Sam’s owner’s basis | $5,500.00 |

Company A is in a partnership with another LTC.

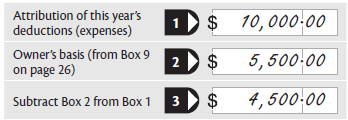

Calculate the non-allowable deductions for Sam:

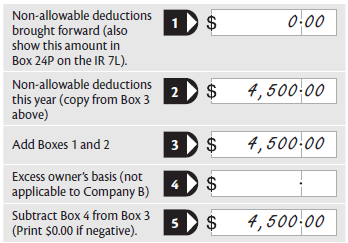

Box 3 is Sam’s non-allowable deductions this year. The amount in Box 3 ($4,500) is shown at Box 24O.

Box 5 is Sam’s non-allowable deductions to carry forward. The amount in Box 5 ($4,500) is shown at Box 24R.

Company A’s IR7L would look like this:

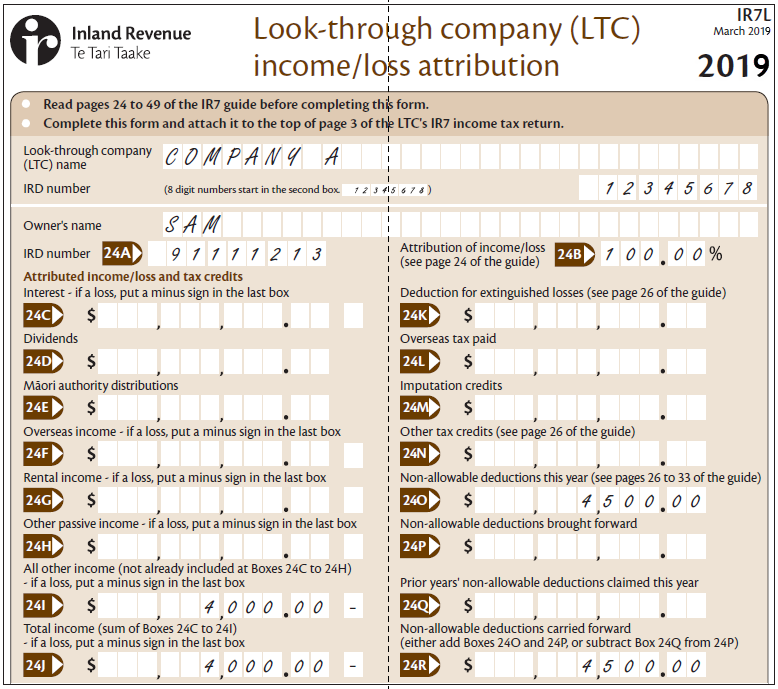

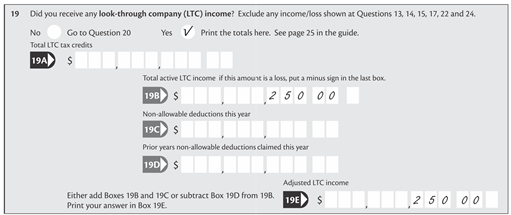

Sam’s Individual income tax return (IR3) Question 19 would look like this:

Sam’s adjusted LTC income is in effect calculated by subtracting his allowable deductions ($5,500) from Company A’s gross income ($6,000) = $500.