IR7 Example 3 LTC loss limitation rule — with non-allowable deductions brought forward

The following details are for Company C which is an LTC in a partnership with another LTC:

IRD number | 22–324-252 |

Total gross income | $6,000 |

Expenses/deductions | $8,000 |

Loss | $2,000 |

Company C’s owners (shareholders) details are:

Linda(50%) | IRD number 62-728-293 |

Marley (50%) | IRD number 31-323-334 |

Both Linda and Marley had non-allowable deductions last year of $500.

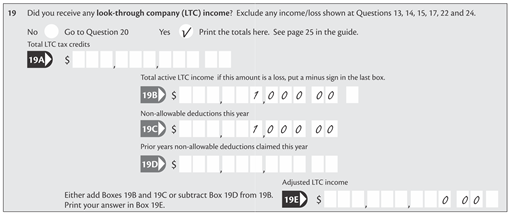

Calculate the non-allowable deductions for Linda and Marley:

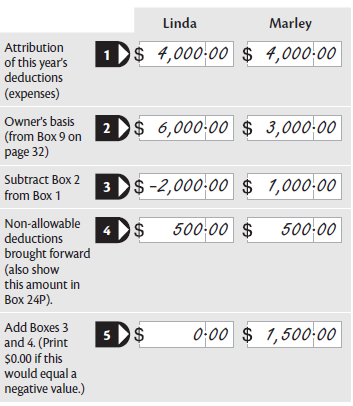

Company C’s IR7L details for Linda would look like this:

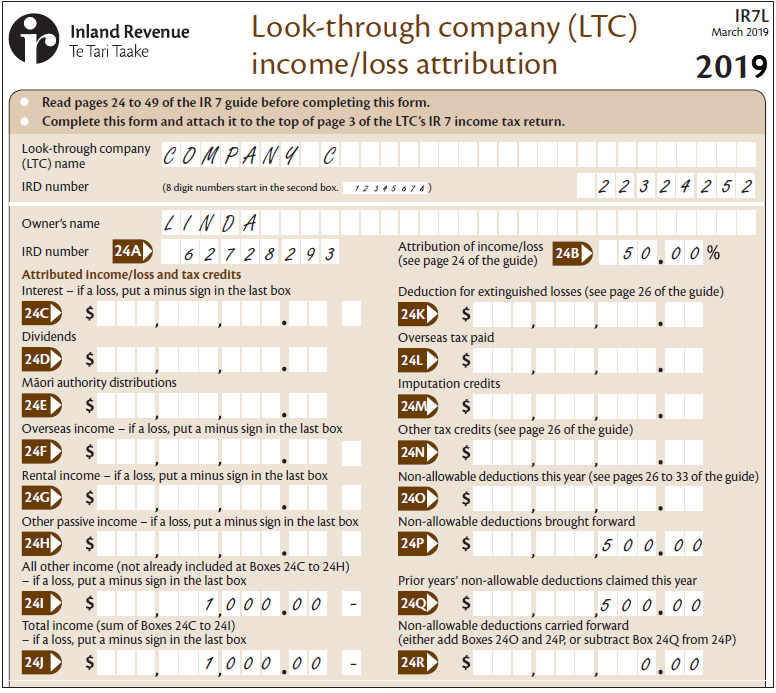

Linda will show her income from Company C on her Individual income tax return (IR3) at Question 19 “Did you receive any look-through company (LTC) income?” as shown below.

Linda’s attribution of this year’s deductions isn’t limited, so she can claim her full share of the loss ($1,000). In addition, she is now able to claim the $500 she wasn’t allowed last year, making her adjusted LTC income a $1,500 loss.

Linda’s IR3 Question 19 would look like this:

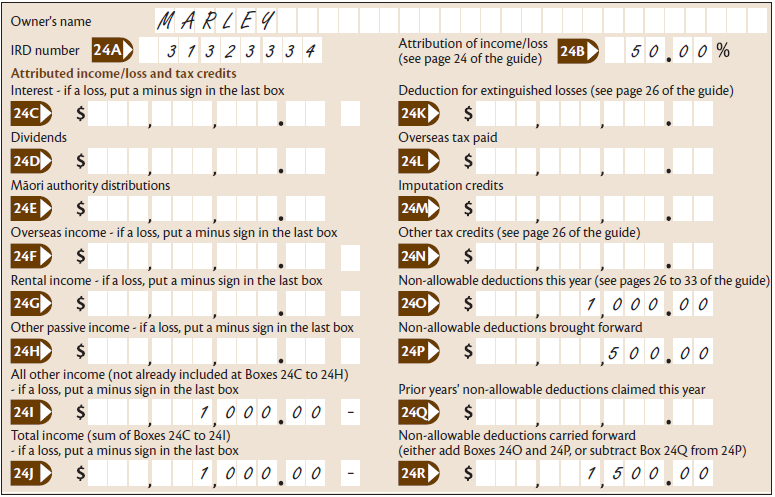

Company C’s IR7L details for Marley would look like this:

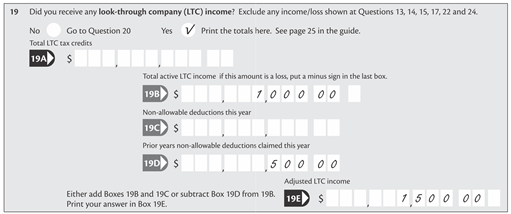

Marley will show his income from Company C on his Individual income tax return (IR3) at Question 19 “Did you receive any look-through company (LTC) income?”.

He would also have $1,500 non-allowable deductions to carry forward to next year.

For Marley, limiting the deductions has the effect of treating his share of the deductions as $3,000. When this amount is allowed against his share of the gross income ($3,000) the result is $0.00, the amount of the adjusted LTC income.

Marley’s IR3 Question 19 would look like this: