IR7 Question 15 Income from another LTC

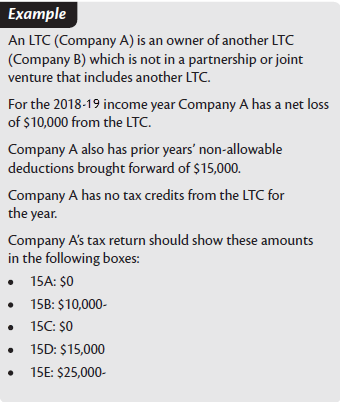

If the LTC received income from another LTC, write the details at Question 15.

A partnership does not receive income or deductions from an LTC. If two or more people jointly receive income or deductions from an LTC, they should show these on their own returns, not the partnership’s return.

LTCs are transparent (looked through), meaning the owners are treated as having received the income and incurred the loss of the company.

The LTC will normally supply the information required to complete your return.

Don’t include any of the following types of income received from another LTC at Question 15:

interest and RWT—show these at Question 11

dividends, imputation credits, and dividend RWT—show these at Question 12

Maori authority distributions and credits—show these at Question 13

overseas income and any credits attached—show these at Question 16, see IR7 Question 16 Overseas income

rental income—show this at Question 18, see IR7 Question 18 Rental income

other income—show this at Question 19, see IR7 Question 19 Other income.