IR7 Question 23 Deduction for losses extinguished on transition from a QC or LAQC

If the partnership or LTC had losses which were extinguished on transitioning from a QC or LAQC, each owner or partner is allowed a deduction for an amount equal to the amount given by the following formula:

(Loss balance extinguished – prior years’ deductions) x partnership share or owner’s effective interest

Note: this is limited to the partner’s or owner’s share of net partnership or net LTC income for the year.

Loss balance extinguished is the loss balance extinguished on transition from a QC or LAQC. If it includes foreign losses please call Inland Revenue on 0800 377 774 to make sure they are accounted for correctly.

Prior years’ deductions is the total amount of deductions for extinguished losses allowed in previous income years for all persons with a share in the partnership, or an effective look-through interest in the LTC. If this is the first year deductions have been claimed for extinguished losses, the amount will be zero.

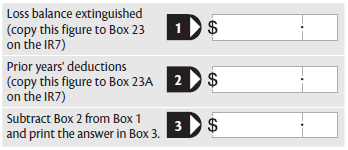

Work out the maximum allowable deduction for each owner or partner using the calculation tables below.

Boxes 1 to 3 only need to be completed once. Use the resulting figures for all owners or partners.

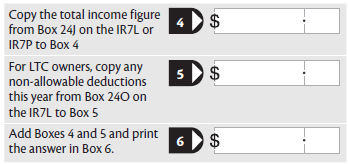

Boxes 4 to 9 must be completed for each owner or partner using their information from the IR7L or IR7P.

If the answer in Box 3 is zero, no further deductions for extinguished losses can be claimed by the owners or partners. If it is greater than zero, continue below.

Information on completing the IR7L is explained later in this guide. Attribution of income/loss is explained at Attribution of income/loss, and how to complete Box 24O is explained at Non-allowable deductions (IR7L only) — where loss limitation rule doesn’t apply for the owner(s) of this guide.

If Box 6 is a loss, the owner or partner isn’t entitled to a deduction this year. If it isn’t a loss, continue below.

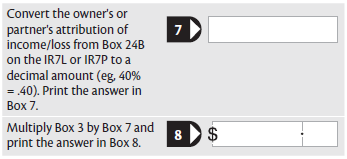

Print the amount from either Box 6 or Box 8, whichever is the lesser, in Box 9 below. This is the maximum deduction for the owner or partner.

Copy the amount from Box 9 to Box 24K on the IR7L or IR7P form.

Add up the maximum deductions for all owners or partners and print the answer in Box 23B of the IR7 return.