IR3 Your record of payment

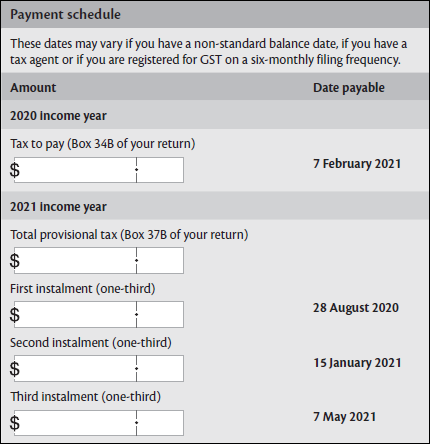

When you’ve worked out how much you have to pay, write the amounts on the schedule below. Keep it as a record so you don’t miss a payment.

The dates on the schedule apply to a person with a 31 March balance date. If your balance date is different or you are registered for GST on a six-monthly filing frequency or if you have a tax agent, your payment dates may be different too. If you aren’t sure, check with your tax agent or call Inland Revenue.

Adjusting an income tax return already filed

If you want to amend or adjust an income tax return that’s already been filed, please send Inland Revenue a Notice of proposed adjustment (IR770) (NOPA) through the disputes resolution process. Don’t send us another return.