Selecting workpapers and financial statements for entity types

When you create a new client in Client Accounting, it will have access to the default special-purpose workpapers and financial statements.

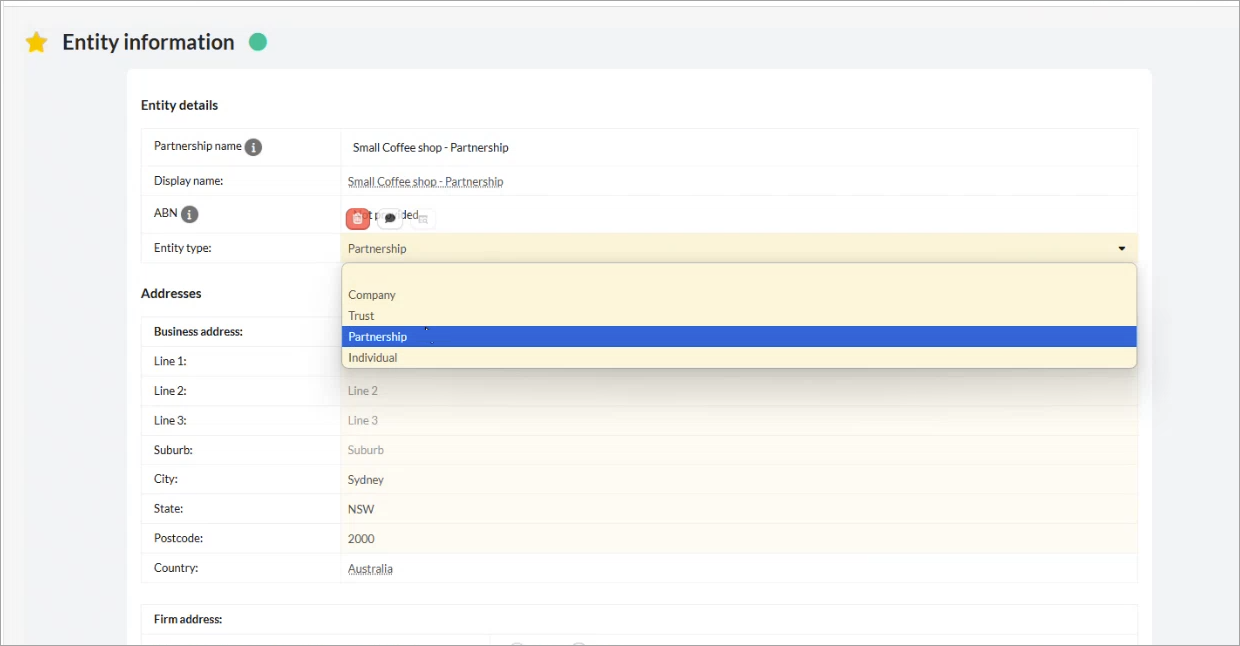

To change the workpapers and financial statements to suit your client's entity (Company, Trust, Partnership, Sole trader), you need to edit the Entity information workpaper.

Edit the Entity information workpaper

In the Client overview screen, click the Workpapers workflow and select the Entity information workpaper.

Select Trust/Partnership/Company/Sole Trader as the Entity type and click Save.

Enter the Trust type and Trustee type. These options are only available once you save Trust as the Entity type.

Complete the details of the Entity information workpaper.

Once completed, this will adjust the workpapers and financial statements to be tailored to your client's entity type.

See the list of workpapers available in Client Accounting