MYOB AE/AO release notes—2019.0b (Australia)

Release date—15 August 2019

This is the latest version of MYOB Tax for:

- Accountants Enterprise (AE)—MYOB AE 2019.0b (including Tax 6.47 SP2 and Tax 8.31 SP2)

- Accountants Office (AO)—MYOB AO 2019.0b

- We've reworded a question in the Work-related expenses schedule (W) to make it clear that you only need to lodge the schedule if the ATO requests it.

- Before: Are you required to, or do you wish to transmit this schedule when applicable?

- After: Do the ATO require you to lodge a work-related expenses schedule?

The ATO have removed cross-form validation tests between the Work-related expenses schedule (W) and the individual income tax return. This avoids an issue that rounded down values to those in the individual return. The issue occurred because schedule W uses a dollar value, but the Deductions schedule requires a dollar and cent value.

The ATO have removed the following validation tests:

Code Message ELS equivalent CMN.ATO.IITR.310132 Work related car expenses amount is incorrect V172A: Work related car expenses and amount claimed on WRE schedule are different CMN.ATO.IITR.310133 Work related travel expenses amount is incorrect V172B: Other work related travel expenses and amount claimed on WRE schedule are different CMN.ATO.IITR.310134 Work related uniform, occupation specific or protective clothing,... expenses' amount is incorrect V172C: Work related uniforms, protective clothing, etc expenses and amount claimed on WRE schedule are different CMN.ATO.IITR.310135 Other work related expenses amount is incorrect V172E: Other work related expenses and amount claimed on WRE schedule are different The AusIndustry Innovation Australia number in the Research and development tax incentive schedule (BY) is now a mandatory field.

The CPI indexation factor for the June 2019 quarter is 114.8. This is an increase of 0.7 from the March 2019 quarter rate of 114.1. The indexation factor is used only for FBT remote area benefits (under ss 60 and 60AA of the FBTAA).

Fuel tax credit rates have been updated to reflect changes as at 5 August 2019.

Interest on overpayments and interest on early payments is 1.54% for the first quarter of the financial year, 1 July to 30 September 2019.

The interest on overpayment rate is used for the calculation of the Credit for interest on No-TFN tax offset in the worksheet provided at:

H5 in the company return, and

H5 and H6 in the two fund returns (EF and MS).

The Activity Statement Obligation homepage now displays partner, manager and employee details that have been entered for a client, without you having to open the activity statement. We'll also display the ABN from the client tab, and branch code from the ATO's Activity Statement Obligation report.

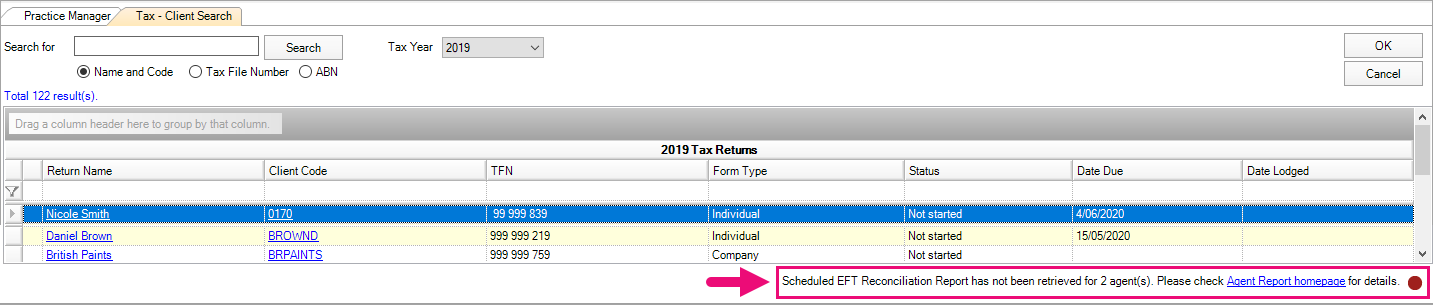

If your practice hasn't received the EFT report for over two days, you'll see a red indicator in the Tax - Client Search homepage.

If you see the red indicator, go to the Agent Reports homepage to check your last received date and Rescheduling the ASLR and EFTRS reports.

ATO prefill amounts for an individual return didn't display apportioned amounts correctly in the dividends (div) schedule (item 11).

We've made some performance improvements to:

the SBR Sender service

- the Activity Statement Obligation homepage.

You no longer need a low value pool to integrate with D6. You can now enter values directly into D6.

The Tax Office copy PDF for the International dealings schedule (IDS) didn't display the number of CFCs and CFTs at items 21b, 12c and 12d.

We've fixed a business km rounding issue that occurred when integrating amounts from the Motor vehicle worksheet (mve) to the Deduction schedule (DDCTNS). This affected D1 Work-related car expenses and D4 Work-related self education expenses.

When you do a batch update in the Depreciation worksheet (d), the batch update options for integration with a form are now the same as the options in individual assets.

We've changed the First home super saver scheme (FHSS) calculation. It now includes the 30% offset that the taxpayer receives on the FHSS amount.

Tax that the ATO withholds on FHSS payments to the taxpayer is now added to the total tax paid amounts in the tax return.

Resolved errors

| Validation errors | |

|---|---|

| V2726A | Check Net Financial Investment Loss If you completed D15 Other deductions label J, with D in Claim Type, this message was incorrectly generated when you validated your returns. |

| V2592B | If entity is a non-authorised deposit taking institution (non-ADI) and 'What was your entity type at the end of the year?' is either 9 or 10 then 'Statement worldwide assets' and 'Average Australian assets' must be completed This error was incorrectly generated in 2019 company returns with an International dealings schedule (IDS). |

| V2522B (IDS.440002) | International related party dealing information in Section A required Question 13f is now available regardless of your answer in question 13 |

| Interest and Dividend (BT) schedule (company return) | |

|---|---|

| CMN.ATO.DIS.500025 | Individual investor- Other given names must not exceed 15 characters |

| Company return | |

| CMN.ATO.GEN.410002 | Address Line 2 must be present if Address Line 1 contains C/- |

| International Dealings schedule (IDS) | |

| CMN.ATO.IDS.440567 | Financial arrangements information is required. If there is a 'Yes' response to 'Did you have a financial arrangement for the purposes of Division 230 that did not give rise to a debt interest for the purposes of Division 974?' then Total TOFA value, Total value of TOFA gains and Total value of TOFA losses must be completed. |

| CMN.ATO.IDS.440620 | Gross revenue of CFCs that have satisfied the active income test - Other unlisted countries is required |

CMN.ATO.IDS.440621 | Gross revenue of CFCs that have not satisfied the active income test - Listed countries is required |

| CMN.ATO.IDS.440622 | Gross revenue of CFCs that have not satisfied the active income test - Specified countries is required |

| CMN.ATO.IDS.440623 | Gross revenue of CFCs that have not satisfied the active income test - Other unlisted countries is required |

| CMN.ATO.XBRL03 | Field contains invalid data (such as letters in numeric or date field) This error occurred if you selected Barbados at question 4b in the International dealings schedule (IDS). The correct country code is now displayed. |

| Individual return (IITR) | |

| CMN.ATO.IITR.730001 | Work related car expenses amount is incorrect Motor vehicle expenses will now be rounded to two decimal places, preventing lodgement errors from rounding differences. |

| CMN.ATO.IITR.730002 | Dividend deductions amount must be provided This error occurred if you inserted rows in D8 with no description text. |

| CMN.ATO.IITR.730107 | AE only Deductions schedule must be provided This error occurs when retain numeric values (not recommended) is selected in the RSD Options window during rollover, and the Deductions schedule (DDCTNS) isn't opened prior to lodgment. |

| CMN.ATO.IITR.730213 | Interest deductions amount must be provided This error occurred if you inserted rows in D7 with no description text. |

CMN.ATO.IITR.730307 | Work related uniform, occupation specific or protective clothing, laundry and dry cleaning expenses must be provided This error occurred if you inserted rows in D3 with no description text. |

| CMN.ATO.XBRL03 | Field contains invalid data (such as letters in numeric or date field) This error occurred if you included the characters [ ] and \ were included in the description fields of the Deductions schedule (DDCTNS). |

| Self Managed Fund returns | |

| CMN.ATO.SMSFAR.437184 | Invalid SMSF Electronic Service Address This error occurs when an Electronic service address alias is rolled from the 2018 return, and the address doesn't match the value from the new SMSF Electronic service address alias selection window. |

| Partnership and trust returns | |

| CMN.ATO.GEN.XBRL03 | A field contains invalid data (such as letters in numeric or date field) This error occurs for partnership and trust returns if item 18 has either an amount or the name of each deduction item, but not both. |

| ATO known issue | |

CMN.ATO.IITR.001089 (The ELS equivalent is V2361) | The spouse is not within the correct age range. The spouse must be between preservation age and 59 at the time they received a superannuation lump sum payment where the taxed element has a zero tax rate As at August 2019, the ATO are reviewing the test that produces this message. We've changed this message to a warning in the meantime. See EI 2019: V2361 (CMN.ATO.IITR .001089) before lodging the return. |

Version numbers in this release

Product | Version number |

|---|---|

MYOB AE/AO | 2019.0 |

Tax Homepages | 7.0.11.418 |

| Tax | 2019.0b (for a 2019 tax return) 2018.3a (for a 2018 tax return) |

To check the AE/AO version:

- Click Help and select About.

- Check the Install Version.

To check the Tax Homepages version:

- Click Help and select About > Plugins

- Scroll down until you see Tax and check the Version.

To check the Tax version:

Open a tax return.

Click Help and select About.

Check the Version.