Client accounting issues

This support note applies to:

AO Assets Live (NZ)

AE Assets Live (NZ)

AO Assets Live (AU)

AE Assets Live (AU)

AE Statutory Reporter (NZ)

AE Statutory Reporter (AU)

AO Statutory Reporter (AU)

Workpapers (NZ)

AO Workpapers (AU)

AE Workpapers (AU)

AE Reporter (NZ)

AE Reporter (AU)

AE MAS (NZ)

AE MAS (AU)

AE Assets (AU)

AE Assets (NZ)

AE Accounts (AU)

This page is a reference for outstanding issues for which we're working on a solution. We'll keep adding issues to this page as they're found.

Before you check the known issues list, make sure you're on the latest release for MYOB AE/AO, including any hotfixes.

Use the Ref no from the tables below if you're calling support for any of these issues.

Issue | Description | Solution | Ref no |

|---|---|---|---|

Under the Tasks > Trial balance, when clicking Manage client File imports , you'll see an error Error: An error occurred while posting the journal transactions | This error occurs when importing a MYE file or MYOBAO.txt file and after mapping the account codes and trying to post the adjustment journals | We're aware of this issue and working on a solution. | 01179461 |

When clicking the Client Accounting tab, you'll get the error message: "The company file version is not supported." | If you've configured an AccountRight desktop version prior to 2022.4, when clicking the Client Accounting tab, you'll get the error message. |

| 01040605 |

Error when you click Launch Ledger: "There was a problem trying to open this version of AccountRight file. One possible reason is the version is not yet supported by Client Accounting." | This error happens when you've configured AccountRight version 2022.4 Server Edition in Client Accounting. | To fix this issue, see Error: "There was a problem trying to open this version of AccountRight file." when AccountRight 2022.4 or later is installed. |

|

Error: System.IO.FileNotFoundException | This error occurs on workstations when selecting the Client Accounting tab. | We're aware of this issue and working on a solution. To fix the issue:

| 00828533 |

Tasks bar options missing when clicking on the Client accounting tab | In MYOB AE/AO, for some clients when clicking the Client Accounting tab, the option on the Tasks bar on the left is missing. | To fix the issue, we'll need to run an SQL script to unlink the ledger so you can link it again. Call support to run the script. Make sure you have access to your SQL server. | 00644477 |

Issue | Description | Solution | Ref no |

|---|---|---|---|

The Imputation Credit to Retained Earnings workpaper is deducting depreciation from the profit twice from the (Profit)/Loss field on the workpaper. | In the Profit or loss statement account group, the Expenses Depreciation includes the accounts:

| To fix the duplicated amounts, remove the account range 477:479 or renumbering it to unused accounts. | 01143629 |

Error: The selected attachments exceed the size limited. Deselect some files and try again. | When you attempt to create a PDF from a workpaper and only select the Adjusted Trial Balance, you'll get the error: "The selected attachments exceed the size limited. Deselect some files and try again." | Print the Trial Balance from the underlying ledger, as in, the AccountRight file, New Essentials file or Cashbook file. | 00290586 |

Error: "Bad Request" when trying to complete a Workpaper period | When trying to complete a workpaper period, you'll get the error message "Bad Request". | When completing the period, untick the Lock period checkbox. | 01041371 |

Error: "SME Platform responded with an unexpected result" or "GeneralJournal_CreditDebitLinesRequired" | These errors happen when you try to post AssetsLive journals from Workpapers linked to New Essentials without tax codes. A GST Tax Type isn't included when a journal is Submitted from AssetsLive. This issue affects version 5.4.42. | After the journal is Submitted, run the Update_amount_for_asset_journals.zip to update the amount for the asset journals.

To find out how to run the script, see Running an SQL script in AE/AO. | 00984275 |

Can't open Workpapers tab from Workpapers Home Page | When you're in the Workpapers tab and open the Client Accounting workpapers, nothing happens. | Open the workpaper from the Client Accounting tab in the client’s record. | 00980057 |

Can't post journals from Client Accounting to New Essentials | When trying to post journals from Client Accounting to New Essentials, the journals may not post. This issue can be caused by a space character at the end of the account code number. | Check each account number code to see if they have spaces at the end. If they contain spaces at end, remove the spaces. | -- |

Can't open workpapers | When opening workpapers, nothing happens. This issue occurs when the files are migrated from Essentials to New Essentials and there are duplicate account codes exists in the New Essentials file | We're aware of this issue and working on a solution. To fix the issue,

| -- |

Can't open a Workpaper period in Client Accounting when linked to a New Essentials file | When a livestock journal is posted to New Essentials from a Livestock - Closing Stock workpaper in Client Accounting, it might have an amount of less than one cent posted for one or more accounts. This journal will stop the Workpaper period in Client Accounting opening. | We're investigating this issue. To work around it:

| 00964413 |

Error: Unable to add journal: Businessline_AccountPostable | This error occurs when posting a distribution journal from AE/AO into New Essentials for a Unit Trust. | We're aware of this issue and working on a solution. As a workaround, set up the income allocation in New Essentials before posting the journal from AE/AO. | 00904761 |

Error: Invalid file format, please use the appropriate file format and try again | This error occurs when attempting to import an .MYE file to MYOB AE/AO Ledger. This error may occur where there are special characters or letters in the Account Codes, or if an Account Code is left blank when exporting transactions. | Follow KB Error: "Invalid file format, please use the appropriate file format and try again" when importing an .MYE file to AE/AO Ledger" to fix the issue. | 00338314 |

Incorrect Franking percentage appears when producing Dividends Paid - Shareholders Distribution Statement workpapers, when the small business tax rate is ticked | The system is using 27.5% instead of 26% when the small business tax rate is ticked. | We're aware of this issue and working on a solution. | 00724519 |

Trial balance is showing as out of balance due to a GST rounding amount from Essentials Accounting. | In a Trial Balance/Workpapers period for an Essentials Accounting ledger, the Trial Balance is showing out of balance due to a rounding amount for a GST account. When you click View Transactions on the account with the out of balance amount, the transaction appears incorrectly rounded when rounding to two decimal places. | As a workaround, post a journal to the historical balance account. | 00393917 |

Duplicate account codes created when migrating to Essentials (New) | When migrating old essentials ledgers into Essentials (New), duplicate account codes are created. | We're aware of this issue and working on a solution. As a workaround,

If you still get an error, check for more duplicates. Note that header accounts also have duplicate account codes. | 00746478 |

Out of balance in Trial balance when there is a blank entry in retained earnings EOFY entry. | When using a New Essentials ledger, the trial balance is out of balance by the amount posted to the Current Year Earnings account. This happens due to a blank entry in the retained earnings. | We're aware of this issue and working on a solution. | 01080363 |

Unable to open Workpaper as transactions have 4 decimal places. | Where an MYOB Business file is configured in Statutory Reporter and has transactions with 4 decimal places, the Workpaper period does not open. | We're aware of this issue and working on a solution. | 01649863 |

Issue | Description | Solution | Ref no |

|---|---|---|---|

Error code 30 or 41 when printing reports. | You get error code 30 or 41 "Printer not activated" when printing reports. | We're aware of this issue and working on a solution. | 00336945 |

Issue | Description | Solution | Ref no | |

|---|---|---|---|---|

MAS Reporter | ||||

Total for the Trade and Other Receivables note total incorrect | In MAS Reporter version 3.5.120 the Total for the Trade and Other Receivables note is calculated incorrectly at Line 34.

| To fix the issue, change the formula in the Trade and Other Receivables note.

If you need help customising the format, contact our support team.

| 00781180 | |

AE Reporter |

|

| ||

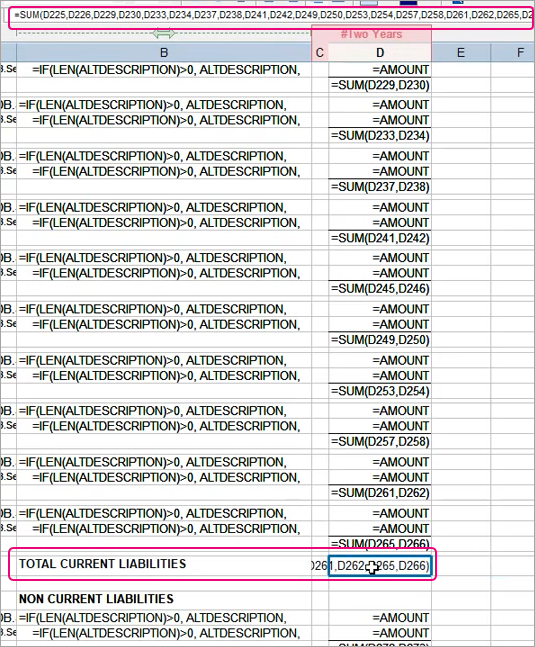

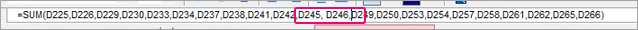

Detailed Balance Sheet report out of balance. | In Reporter 3.5.119, in the 2020 reporter year for the company entity type, the Detailed Balance Sheet report shows as out of balance due to the subtotal for Total Current Liabilities not adding up correctly. This issue occurs for 2020, 2021 and 2022 company ledgers. | To fix the issue, change the formula in the Balance Sheet Detailed formats.

If you need help customising the format, contact our support team. | 00402612 | |

Issue | Description | Solution | Ref no | |

|---|---|---|---|---|

The Income Tax Expense policy note is incorrectly showing the movement in the expense. | The Income Tax Expense policy note is showing the movement in the expense instead of the closing balance in part a) of the Note Account 480 (Income tax expense) is correctly assigned in the Account Group | We're aware of this issue and working on a solution. | 01107456 | |

On the Statement of Changes in Equity for the Other Trust or Unit Trust, the distribution to beneficiaries line shows the movement of the account code but the total section reports the closing balance. | The Statutory Reporter Designer shows the section the account code is assigned to show the Net Change balance type. | While we're working on a fix, export the report and edit in Word. Also, correct the report sections so they either report net movement/change or closing balances. | 01107039 | |

JPG logo doesn't appear in documents when exported to Word or Excel | When you insert a JPG file as a logo into the reports in Statutory Reporter, the logo doesn't appear in any documents exported to Word or Excel (e.g. missing from the cover page). The issue doesn't affect PDF documents and the logo will still appear in them. | We're aware of this issue and working on a solution. | 01059036 | |

Error: "Failed to generate report preview. Please try again later | When you try to generate a preview of Practice Reports (Maintenance > Client Accounting, Practice Report Settings), you may see the following error message: Failed to generate report preview. Please try again later This issue affects version 5.4.43. | We're aware of this issue and working on a solution. | 01061288 | |

Other income showing after sales for one department | When producing department income statements in Statutory Reporter, the Income account codes may appear in the section after Sales. This is incorrect as income should only appear at the start of the report if Sales equals $0.00. This issue affects version 5.4.42.111. It doesn't affect departments setup as sub codes. | If your departments are setup as prefixes and all Sales account codes are linked to an Account Type Group, you can trigger Income to appear directly after Sales:

| 01028286 | |

Multiple report formats missing section headers and section totals after AE/AO update 5.4.41 | Some reporting formats are missing after the 5.4.41 update. Some examples are:

| This issue is fixed in hotfix version - AE/AO Client Accounting KB73400898 hotfix (Australia & New Zealand) | 00826820 | |

Notes to Financial statements not appearing in the Balance sheet. | In the Notes to the Financial Statements, when using the Layout PTD/LYPTD the line does not appear in the note for the Balance Sheet item. For example for the year ending 31/3/2019, for the period April 2019 to December 2019, the line for the Balance Sheet item Cash and Equivalents will show, however in the Notes to the Financial Statements, the Cash and Equivalents Note will not show the line. | We're aware of this issue and working on a solution. | 00290302 | |

Statutory reporter previews display incorrectly. | When previewing reports in Statutory reporter, the report window may have trouble displaying properly if you set your Windows scaling settings above 100% on high-resolution monitors. | Decrease the scaling in your Windows settings to 100% or 150%. | 00395592 | |

Superfund Operating Statement shows the movement for the | For the entity type Superannuation Fund, in Account Groups when allocating an account to the folder SMSF > Profit and Loss Statement > Benefits Accrued > Benefits Transfer In, the Operating Statement in Statutory Reporter shows the movement for the account balance rather than the final balance. | We're aware of this issue and working on a solution. | 00281627 | |

Error: Failed to generate report preview. Please try again later an instance of an object. | When trying to Insert/Remove a Line/Page break in a Stat Report, you may see the | We're aware of this issue and working on a solution. | 00602161 | |

The Schedule of Proprietor’s Current Account shows incorrect the Profit(Loss) for the year.

| For Individual entities, the Schedule of Proprietor’s Current Account shows the Profit(Loss) for the year after the Opening Balance rather than in the section for Add.

| We're aware of this issue and working on a solution. | 00290304 | |

Error: You have not confirmed the upgrade of this client. Click here to run the upgrade wizard | Error: You have not confirmed the upgrade of this client. Click here to run the upgrade wizard This error can occur after an upgrade. | This error can occur when there are customized account groups. To generate reports, run the upgrade wizard on each client where you have customised account groups. You'll need to do the customisations again as this will change the Account Groups at master level. The upgrade wizard provides a report on the account ranges that were affected. | 00342777 | |

Issue | Description | Solution | Ref no |

|---|---|---|---|

Unable to sell assets | When trying to sell assets, you may see the error: Could not cast or convert from system.string to system.collections.generic.list'1[system.string]. | To fix the issue, click View in Browser on the Tasks bar to open Assets in MYOB Practice and then sell the assets. See Selling an asset | 00394325 |

Motor Vehicle Cost Limit picking up 2020 value for the 2021 year. | When creating a motor vehicle, the cost limit still shows the 2020 cost limit ($57,581) instead of 2021 cost limit ($59,136 $53,760 net of GST)). | We're aware of this issue and working on a solution. | 00737172 |

An asset is written off incorrectly when purchased prior to 28/01/2019 with a cost of between 20000 and 30000. | In 2019, when adding an asset to the pool purchased prior to 28/01/2019 with a cost of between 20000 and 30000 is immediately written off, rather than added to the pool to be depreciated. | We're aware of this issue and working on a solution. | 00290242 |

Issue | Description | Solution | Ref no |

|---|---|---|---|

Incorrect printing in Trustee Declaration | Trustee's Declaration is not showing the word DIRECTORS when they have multiple directors | We're aware of this issue and working on a solution. | 00910155 |

Issue | Description | Solution | Ref no |

|---|---|---|---|

View transaction window incorrect | The View transaction window does not show the bank account transactions that are cash payment & cash receipts transactions except that are entered through general ledger or sales or Purchases. | We're aware of this issue and working on a solution. As a workaround, post the transaction to a non-bank account in the MYOB Business ledger. | 00910155 |

Need help?

Contact our support team. We're available Monday to Friday. 9am to 5pm (Melbourne/NZ time).