Item P8 - Business income and expenses

See Item P8 Business income and expenses on the ATO website for further information.

For ATO information on these income labels click the links to item P8 that are provided to take you to the ATO website. You may then need to expand the list in the left-hand panel and expand the list under Income, then click the label you require.

For former STS taxpayers, click this link for information on Concessions for small business entities on the ATO website.

Income

Label C and D - Gross payments where ABN not quoted

See Gross payments where ABN not quoted on the ATO website for further information.

You must complete a Payment Summary schedule (PS) if the taxpayer has received either or both of Primary Production or Non-Primary production income from which tax was withheld due to failure to quote an ABN. The Income Code is B and the Type Code is N. Integration from the PS will complete the labels at P8 and item 15. See Payment summary schedule (PS).

CCH References

7-050 Small business entities - aggregated turnover

7-050 Affiliates or connected entities

7-370 Paying GST by quarterly instalments

7-530 FBT car parking exemption

7-250 Small business depreciation

7-260 Simplified trading stock rules

17-015 Depreciating assets

Label B (NPP only) - Gross payments subject to foreign resident withholding (excluding capital gains)

See Gross payments subject to foreign resident withholding on the ATO website for further information.

You must complete a Payment Summary schedule (PS) if the taxpayer has received income that was subject to foreign resident withholding (excluding capital gains). This is Non-Primary production (NPP) income.

The Income Code to select is B and the Type Code is F. Integration from the PS will complete the labels at P8 and item 15. Refer to Payment summary schedule (PS).

CCH References

7-050 Small business entities - aggregated turnover

7-130 Affiliates or connected entities

7-530 FBT car parking exemption

7-370 Paying GST by quarterly instalments

16-045 Special rules for deducting pre-paid expenses

7-250 Small business depreciation

17-015 Depreciating assets

7-260 Simplified trading stock rules

Labels E and F - Gross payments voluntary agreement

See Gross payments voluntary agreement on the ATO website for further information.

You must complete a Payment Summary schedule (PS) if the taxpayer has received income that was subject to voluntary agreement to withhold tax. This type of income can only be Non-Primary production. The Income Code is B and the Type Code is V. Integration from the PS will complete the labels at P8 and item 15. See Payment summary schedule (PS).

CCH References

7-050 Small business entities - aggregated turnover

7-050 Affiliates or connected entities

7-370 Paying GST by quarterly instalments

16-045 Special rules for deducting pre-paid expenses

7-530 FBT car parking exemption

7-250 Small business depreciation

7-260 Simplified trading stock rules

17-015 Depreciating assets

Label N and O - Gross payments, labour hire or other specified payments

See Gross payments labour hire or other specified payments on the ATO website for further information.

You must complete a Payment Summary schedule (PS) if the taxpayer has received income that was subject to labour hire or other specified payments from which tax was withheld.

This type of income can only be Non-Primary production. The Income code to select is B and the Type Code is S. Integration from the PS will complete the labels at P8 and item 15. Refer to Payment summary schedule (PS).

CCH References

7-050 Small business entities - aggregated turnover

7-050 Affiliates or connected entities

7-370 Paying GST by quarterly instalments

16-045 Special rules for deducting pre-paid expenses

7-530 FBT car parking exemption

7-250 Small business depreciation

7-260 Simplified trading stock rules

17-015 Depreciating assets

Label G and H - Assessable government industry payments

See Assessable government industry payments on the ATO website for further information.

Action code: If the Primary Production amount entered includes fuel tax credits or a fuel grant under the energy grants credits scheme, select D from the list. Otherwise, leave the relevant action code blank.

Similarly, for the Non-primary production amount entered, select D if the amount includes fuel tax credits or a fuel grant under the energy grants credits scheme. Otherwise, leave the relevant action code blank.

Business worksheets C and B

Enter the amount directly in the return or click label G to open Schedule C (primary production worksheet).

Enter the amount directly in the return or click label H to open Schedule B (business income worksheet).

If worksheet C or B is used and you've also completed a payment summary schedule (PS) when you save the C or B all the fields are overwritten except the PS fields C, E, N and G and D, B, F, O and H. To record your Assessable government industry payments for labels G and H, you will need to key these manually in each worksheet as applicable, in the special field provided as shown in the screenshot below. The field is located below the gross profit from trading.

CCH References

7-050 Small business entities - aggregated turnover

7-050 Affiliates or connected entities

7-370 Paying GST by quarterly instalments

16-045 Special rules for deducting pre-paid expenses

7-530 FBT car parking exemption

7-250 Small business depreciation

7-260 Simplified trading stock rules

17-015 Depreciating assets

Label I and J - Other business income

See Other business income on the ATO website for further information.

Enter the amount directly in the return or click label I to open Schedule C (primary production worksheet).

Enter the amount directly in the return or click label J to open Schedule B (business income worksheet).

Worksheets B and C

If worksheet B or C is used the income entered in the worksheets must agree with the Labels in the main return. For this to happen, the total of the amounts entered in the Payment Summary schedule for the non-primary production Labels D, B, F and O or the primary production labels C, E and N must also be entered in the fields located in the worksheet above the access point to the Payment Summary schedule. Access to the Payment Summary is provided from worksheets to assist you to confirm the amounts to be entered.

CCH References

7-050 Small business entities - aggregated turnover

7-050 Affiliates or connected entities

7-370 Paying GST by quarterly instalments

16-045 Special rules for deducting pre-paid expenses

7-530 FBT car parking exemption

7-250 Small business depreciation

7-260 Simplified trading stock rules

17-015 Depreciating assets

Total business income

MYOB Tax calculates the total for each type of income, the total for primary production income, the total for non-primary production income and the overall total income. Click this link for ATO information about Total business income.

Expenses

See Business and professional item P8 Expenses on the ATO website for further information.

For ATO information on these expense labels click the links to item P8 that are provided to take you to the ATO website. You may then need to expand the list in the left hand panel, then expand the list of Expenses and click the exact label you require.

Cost of sales

See Cost of sales on the ATO website for further information.

Cost of sales is the cost of anything produced, manufactured or acquired or purchased for manufacture, sale or exchange in deriving the gross earnings of the business. It includes freight inwards and may include some external labour costs (if these are recorded in the Cost of sales account in the normal business accounts).

Cost of sales is calculated by Tax as the result of Opening Stock plus Purchases and other costs less Closing stock.

Small Business Entities

Label K - Opening stock: Click this link for ATO information about Opening stock.

Label L - Purchases and other costs: Click this link for ATO information about Purchases and other costs.

Former STS Taxpayers

If the taxpayer is eligible and continuing to use the STS accounting this year, show only purchases and other costs that have been paid at label L.

Label M - Closing stock: Click this link for ATO information about Closing stock.

Other businesses

See Other businesses on the ATO website for information on opening stock, purchases and other costs, closing stock and cost of sales

CCH References

7-050 Small business entities

7-260 Simplified trading stock rules

9-190 Cost of trading stock

7-260 Simplified tax system treatment of trading stock

Label U (NPP only) - Foreign resident withholding (excluding capital gains) expenses

See Foreign resident withholding expenses on the ATO website for further information.

This expense type relates specifically to Non-Primary Production income. Include all expenses that directly relate to income subject to foreign resident withholding (excluding capital gains).

Do not include these amounts at other expense labels.

CCH References

22-010 Non-resident withholding

26-265 Payments to foreign residents

31-230 Withholding tax: interest, dividends and royalties

Label F - Contractor, sub-contractor and commission expenses

See Contractor, sub-contractor and commission expenses on the ATO website for further information.

CCH References

16-015 Expenses necessarily incurred in carrying on a business

26-150 Payments for work or services

39-022 Employer - employee and contractual relationships

Label G - Superannuation expenses

See Superannuation expenses on the ATO website for further information.

Show at label G the employee superannuation expenses incurred for the income year. Do NOT include any amount that was a contribution for the taxpayer. The deduction for personal superannuation contributions must be claimed at item D12.

CCH References

13-710 Deduction - contributions by employers

16-015 Expenses necessarily incurred in carrying on a business

16-575 Deductions for superannuation contributions

Label I - Bad debts

See Bad debts on the ATO website for further information.

Include income from the recovery of bad debts at Other business income label I or J.

CCH References

16-015 Expenses necessarily incurred in carrying on a business

16-910 Commercial debt forgiveness

16-580 Deductions for bad debts

Label J - Lease expenses

See Lease expenses on the ATO website for further information

This is expenditure incurred through both financial and operating leases on leasing assets such as motor vehicles, plant, etc.

Do not include the cost of leasing real estate (show that type of expense at Rental expenses, label K), or capital expenditure incurred to terminate a lease or licence. Related Topics

CCH References

7-050 Small business entities

16-015 Expenses necessarily incurred in carrying on a business

16-310 Motor vehicle expenses - leasing charges

Label K - Rent expenses

See Rent expenses on the ATO website for further information.

This is expenditure the taxpayer incurred as a tenant for rental of land or buildings used in the production of income, including the cost of leasing real estate.

CCH References

7-050 Small business entities

16-015 Expenses necessarily incurred in carrying on a business

Label Q - Interest expenses within Australia

See interest expenses within Australia on the ATO website for further information.

If an amount of interest is included that is not allowable as a deduction, such as amounts denied by the thin capitalisation rules, these will need to be added back at label H, Expense reconciliation adjustments.

Label R - Interest expenses overseas

See interest expenses overseas on the ATO website for further information.

CCH References

7-050 Small business entities

16-015 Expenses necessarily incurred in carrying on a business

16-740 Interest expense

Label M - Depreciation expenses

See Depreciation expenses on the ATO website for further information.

Use the Depreciation worksheet (d) to manage all depreciating assets under the Small business simplified depreciation rules, the uniform capital allowance (UCA) or Pooling.

The depreciation worksheet (d) is linked via the Integration tab to both the Schedule C (primary production worksheet) and the Schedule B (business income worksheet).

Small business entities can claim an immediate deduction for most depreciating assets purchased after 12 May 2015 and first used or installed ready for use for a business purpose:

- from 7.30pm (AEDT) on 2 April 2019 until 30 June 2020, if they cost less than $30,000 each

- from 29 January 2019 and before 7.30pm (AEDT) 2 April 2019, if they cost less than $25,000 each

- before 29 January 2019, if they cost less than $20,000 each.

Businesses that are not small business entities, see the information under the heading Other Businesses below.

Carbon sink forests

See Carbon sink forests on the ATO website for further information.

Other Businesses

See Depreciation expenses on the ATO website for further information.

You show at label M Depreciation expenses the depreciation claimed in your books of account other than for those assets allocated in a prior year to a general pool or a long-life pool.

For assets allocated to such a pool, include here the amount of the pool deduction to be claimed for tax purposes.

Include here claims for instant asset write off for businesses with a turnover from $10 million and less than $50 million for assets costing less than $30,000 purchased from 7.30pm (AEDT) on 2 April 2019 and first used or installed ready for use by 30 June 2019.

CCH References

7-050 Small business entities

16-015 Expenses necessarily incurred in carrying on a business

17-000 Overview of uniform capital allowance system

17-005 Deduction for depreciating assets

17-325 Small business simplified depreciation rules

Label N - Motor vehicle expenses

See Motor vehicle expenses on the ATO website for further information.

Use the Tax motor vehicle worksheet (mve) for the calculation of business motor vehicle expenses. This worksheet provides functionality to calculate the optimum amount and default the method that gives the best result for the taxpayer and permits the apportioning of deduction calculated to other relevant items in the return and worksheets that integrate to those items. Refer to Motor vehicle worksheet (mve).

A field for Amounts from the MV schedule is included in both schedules B and C. Integration is provided by selecting either schedule B or schedule C from the list on the Motor Vehicle schedule at item 07 Allocation off expenses.

You Need to Know:

Special substantiation and calculation rules for car expenses apply to an individual. Under these rules, motor vehicle expenses can be claimed using one of four methods where the expense is for a motor car, station wagon, panel van, utility truck or other road vehicle designed to carry a load less than one tonne or fewer than nine passengers. For a full explanation refer to Item D1 - Work-related car expenses.

To confirm the Per Kilometre rates, select Maintenance > Tax Rates > Motor Vehicles.

CCH References

7-050 Small business entities

16-015 Expenses necessarily incurred in carrying on a business

16-310 Deductible motor vehicle expenses

Label O - Repairs and maintenance

See Repairs and Maintenance on the ATO website for further information.

CCH References

16-015 Expenses necessarily incurred in carrying on a business

Label P - All other expenses

See All other expenses on the ATO website for further information.

CCH References

7-050 Small business entities

16-015 Expenses necessarily incurred in carrying on a business

Reconciliation items

Use the Tax Reconciliation worksheet (Schedule A) to enter all income and Expense add backs and subtractions. The Reconciliation worksheet presents a comprehensive set of fields to enter adjusting amounts between accounting income and taxable income. Click Alt+S at any reconciliation item to open the Reconciliation worksheet (Schedule A). Refer to Schedule A Reconciliation.

See Business and professional item P8 Reconciliation items on the ATO website for further information.

Reconciliation adjustment labels

Label | ATO Information |

|---|---|

Label A: Section 40-880 deduction | |

Label L: Business deduction for project pool | |

Label W: Landcare operations and business deduction for decline in value of water facility, asset and fodder storage asset | See Landcare operation and business deductions for decline in value of water facility. |

Labels X and H: Income and Expense reconciliation adjustments | |

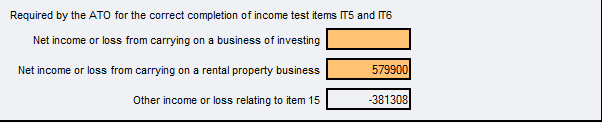

Dissection of net income/loss for ATI purposes | The field in the MYOB Tax box is required to help the ATO in calculating Adjusted taxable income (ATI) or Rebate income (RI) for offset and certain credit purposes.  |

CCH References

7-050 Small business entities

9-040 Accounting profits and taxable Income

11-350 CGT event K7 - balancing adjustments for depreciating assets

16-156 Write-off for business capital expenditure

18-080 Water facilities

19-050 Deduction for pooled project expenditure

19-100 Site rehabilitation expenditure

19-110 Deduction for environmental protection activities

20-470 Deduction for capital works expenditure

Labels D and E - Deferred Non-commercial Business Losses from a Prior Year

See Net income or loss from Business this year on the ATO website for further information, which includes a link to Deferred non-commercial losses from a prior year.

At labels D and E use the Holding dialog to record these figures and pass them to the correct labels in the income tax return.

Label D: Primary production Deferred non-commercial losses

Enter the amount of any primary production losses the taxpayer deferred in a prior year from activities that are the same or similar to the current year activity.

Label E: Non-primary production Deferred non-commercial losses

Enter the amount of any non-primary production losses the taxpayer deferred in a prior year from activities that are the same or similar to the current year activity.

CCH References

16-020 Limit on losses from non-commercial business activities