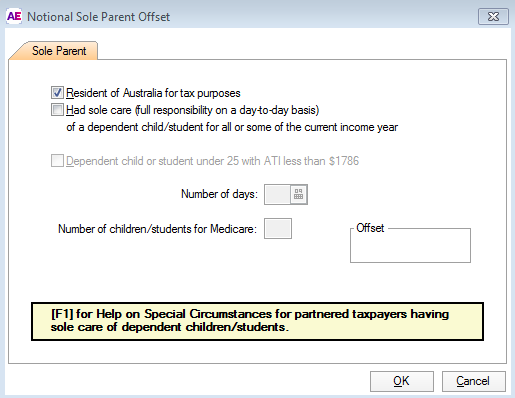

Notional Sole Parent 2023

Sole care means that the taxpayer alone had full responsibility on a day-to-day basis for the upbringing, welfare and maintenance of a child or student. The taxpayer is not considered to have had sole care if they were living with a spouse (married or de facto) unless special circumstances exist.

This dialog is used for entering the number of days a taxpayer was the sole carer of one or more dependent children.

Dependent child or student under 25 with ATI less than $1786: Students under 25 must be in full-time education. Selecting this checkbox will permit the calculation of the notional Sole Parent Offset to be included in the Base Amount for the purposes of calculating the Zone and Overseas Forces rebate. Leaving this checkbox unticked indicates that an offset is not applicable.

Number of Days: Enter the number of days the taxpayer had sole care of the dependent child or student.

Number of children/students for Medicare: Enter the number of children/students. The number of children should be included at item M1 for the Medicare Levy calculation to be based on Family Income.

Sole Parent Special circumstances

If you had a spouse (married or de facto) at any time during 2017-18, you are entitled to a notional sole parent tax offset only in special circumstances.

Generally, for special circumstances to exist, you must have been financially responsible for and have had sole care of the dependent child or student, without the support a spouse normally provides.

Examples of situations where special circumstances may arise:

You were married or in a de facto relationship at any time during 2017-18 but during the year you separated from or were deserted by your spouse, and for the period that you will claim the sole parent tax offset you were not in a de facto relationship.

Your spouse was in prison for a sentence of at least 12 months.

Your spouse was medically certified as being permanently mentally incapable of taking part in caring for your child or student.

If you are unsure whether special circumstances applied, then phone 13 28 61

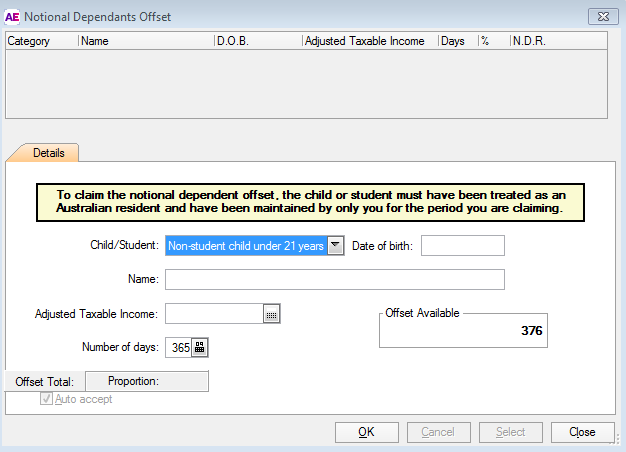

Notional Dependant offset

Dependent children are those under 21 years of age on 30 June 2018; Dependent students are those under 25 years on 30 June 2018 in full-time education at a school, college or university.

This is a transactional dialog used to record more than one entry for details of dependent children/students. These transactions are for the purposes of calculating any notional offsets that are to be included in the Base Amount when calculating the Zone and Overseas Forces rebate.

When all details have been completed, the entry will be moved out of Details and a fresh set of fields will be provided for the next child or student.

Child/Student: In order that the correct notional amount ($376 for each Student under 25 and $376 for the first child under 21 and $282 for each subsequent child under 21). From the list select either Child (under 21) or Student (under 25).

Date of Birth: Enter the dependant's date of birth. An error message will be generated if the child's or student's age is outside of the legislated age.

Name: Enter the dependant's name. This is for record keeping purposes only.

Adjusted Taxable Income: Enter the dependant's Adjusted Taxable Income. Amounts above $1786 will be pro-rated against the maximum notional offset available.

Number of Days: Enter the number of days the dependant was maintained by the taxpayer.

Proportion: Enter the percentage of the taxpayer's contribution to the maintenance of the dependant.

Offset available: The amount calculated for each entry is displayed in this field.

When all the children and students details have been entered, select the Close button to exit.