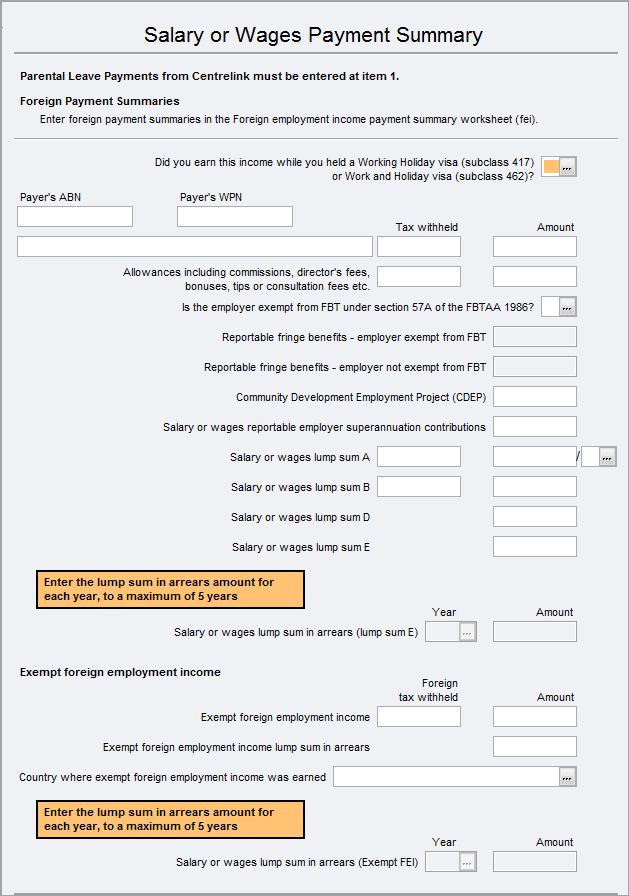

Salary or wages payment summary(egc) 2023

If you have foreign employment payment summaries, see Foreign employment income payment summary (fei) 2023

Complete the Salary and wages payment summary (egc) to report Australian income at Item 1. You can report up to 57 payments using this worksheet.

New fields in the worksheet

There are some new fields in the egc worksheet:

| Fields | Description |

|---|---|

| Is the employer exempt from FBT under section 57A of the FBTAA 1986? | Select Y/N at this question. This will enable/disable the Reportable fringe benefits - employer exempt and Reportable fringe benefits - employer not exempt from FBT |

| Community Development Employment Project (CDEP) | This amount is also reported at Item 5 - Australian Government allowances and payments like Newstart, Youth Allowance,Jobseeker and Austudy payments 2023. |

| Salary or wages lump sum D | Genuine redundancy payments |

| Salary or wages lump sum E | lump sum in arrears (LSIA) payments |

| Salary or wages lump sum in arrears - Year/Amount | This filed will be enabled if you've entered an amount at Salary or wages lump sum E. |

| Exempt foreign employment income tax withheld and amount | This amount is also reported at Item 20 - Foreign source income and foreign assets or property 2018 2018 |

| Exempt foreign employment income lump sum in arrears | This amount is also reported at Item 20 - Foreign source income and foreign assets or property 2018 2018 |

| Country where exempt foreign employment income was earned | This amount is also reported at Item 20 - Foreign source income and foreign assets or property 2018 2018 |

| Salary or wages lump sum in arrears (Exempt FEI) - Year/Amount | This field will be enabled if you've entered an amount at Exempt foreign employment income lump sum in arrears. |

Each payment can be broken down to a maximum of 5 years. Press CTRL + INSERT to add a record.