Getting started with PLS activity statements

Overview

- From MYOB Tax version 2018.1 or later, you can lodge activity statements via PLS.

- PLS allows you to pre-fill your forms with ATO data and pre-lodge them.

- Pre-lodging saves time on data entry.

- Data accuracy is checked against the ATO's records in real-time.

- Lodging the activity statements uses the same process as lodging the tax returns in PLS.

Check out our PLS webinar to learn about the new workflow

Click the chapters

1. Schedule

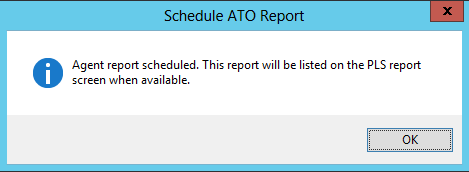

Schedule the activity statement lodgment report (in the Agent Reports homepage)

The activity statement lodgment report (ASLRPT) lists all the outstanding activity statement obligations for your agents.

You need to schedule a time to download the ASLRPT. It's best to schedule it overnight, say between 10 pm and 7am.

When you've scheduled the daily report for an agent, you can view it on the Activity statement obligations homepage (ASO) homepage.

- The ASLRPT will remove activity statements that are not outstanding with the ATO (not in the ATO tax agent portal) if the activity statements are not started. If the activity statements are not outstanding with the ATO, but have an In progress status, you need to manually delete them.

2. Pre-fill

Pre-fill and validate an activity statement (in the Activity Statement Obligations homepage)

- After downloading the ASLRPT, you'll see a list of your clients' outstanding activity statement obligations on the Activity statement obligations homepage (ASO) homepage.

- To create an activity statement click the client's name. See Creating activity statements in the obligations homepage.

- When you create an activity statement from the ASO homepage, it's pre-filled with ATO data. See Which fields are pre-filled in activity statements?

After pre-filling, you can check the data in the form, then validate and complete it.

Because the ASLRPT lists all outstanding activity statements for all tax obligations from 2015 onwards, you can prepare activity statements for any period using the current year of Tax.

3. Pre-lodge

Pre-lodge the activity statement (in the Activity Statement Obligations homepage)

- Pre-lodge an activity statement is a validation check done in real-time against the ATO's records.

You can avoid delays by pre-lodging activity statements before sending them for signature.

If you don't pre-lodge, and your data doesn't match the ATO's records, you'll receive a lodgment rejection. See CMN.ATO.AS.EM060 when lodging Activity Statements via PLS.

4. Lodge the form

Lodge the form (in the Lodgment Manager homepage)

- Lodge your activity statements from the Lodgment Manager homepage in the same way that you lodge your tax returns.

- Any activity statements you completed before your upgrade to version 2018.1 or later:

won't display in the Lodgment Manager homepage

won't have the new mandatory Form Type field

are available to open in the activity statement obligations homepage. Open the statement, overwrite the details to make it PLS compliant, then re-complete the form.

- In the Lodgment Manager homepage, add fields to the field chooser to help you manage the lodgment of activity statements, such as DIN,period from, and period to.

Related topics

Activity statement form types in PLS

Creating an activity statement for a client not on the obligations homepage

Lodge by agent and lodge by client option