GST 103 Adjustments

Key point

There is often a crossover between personal and business use of goods and services. You need to adjust your GST return to reflect this.

In some instances, you may need to calculate a GST adjustment to either pay GST, for example, for a business asset used privately, or claim back GST that’s already been paid, for example, for a private asset used for business. See part 4 of this guide.

You may also need to make adjustments for certain late claims and credit or debit notes that include GST at the old rate of 12.5%.

For other adjustments, you’ll need to work out the private or exempt portion of various income and expenses.

Many small businesses get help from their accountant/tax agent for adjustments. If you don’t have an accountant/tax agent, see page 25 for more information, go to www.ird.govt.nz/gst or call Inland Revenue on 0800 377 776.

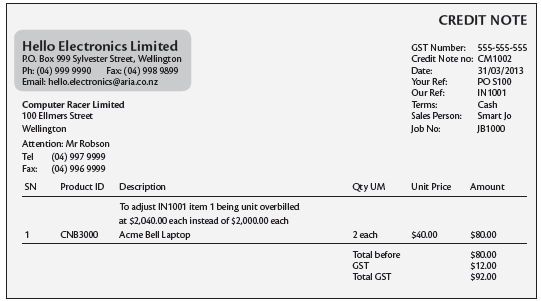

Credit and debit notes

You may have to include credit and debit notes in your calculations when you’re making an adjustment.

Credit notes are issued when the price of a supply has reduced after a tax invoice was issued, for example, the return of faulty goods.

Debit notes are issued when the price increases after a tax invoice has been issued.

Example