IR215 Section D—Business activities

If you’re the settlor of a trust, Inland Revenue may treat some or all of the income the trust receives (that isn’t distributed as beneficiary income) as income for calculating student loan repayment obligations and WfFTC entitlements. Include this amount at Question 19.

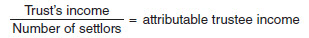

Use the following formula to calculate the amount of trustee income:

If the trust has a controlling interest in a company, you’ll also need to include the company’s income.

Add the company income to the trust’s income to determine the attributable trustee income.

The trust’s income, company’s total income or company’s total net income must be adjusted to include the full amount of any refunds or deposits to the main income equalisation scheme in order to reverse its effect.

If you are a shareholder-employee in a company where you and any associated persons hold 50% or more of the voting interests, the total value of attributable fringe benefits received is treated as income for student loan and WfFTC. Include the value of the attributed fringe benefits and the FBT payable at Question 20.

Attributable fringe benefits are employer-provided:

motor vehicles for private use

low/nil-interest employee loans

subsidised transport (when the employer is in the business of transporting the public) over $1,000 in value

contributions to insurance schemes, sickness, accident or death funds over $1,000 in value

any other benefits received over $2,000 in value.

If you receive fringe benefits but you or your associates (for example, a family trust) aren’t shareholder-employees of the company you work for, you don’t need to include the fringe benefits in your income

If you have a loss from running a business, making investments or a rental property, Inland Revenue won’t include it in the calculation to work out your student loan and WfFTC entitlements/obligations.

You only need to tell Inland Revenue the amount of a loss if you have:

made a loss and profit from two or more unrelated businesses or investment activities, and

entered the net amount in only one box on your IR3 return.

Example:

Angela’s IR3 return shows income from her farming business of $60,000 (self-employment) and a loss from renting out commercial buildings of $25,000.

If Angela declared the income and loss in separate boxes in her IR3 (for example, self-employment and rents) she doesn’t need to tell Inland Revenue. Inland Revenue automatically treat the loss as nil.

But, if she declared the net amount in one box, for example, self-employment income of $35,000, Angela needs to tell Inland Revenue about the $25,000 loss by entering $25,000 at Question 21.

Any deposit made this income year, by you, into your individual income equalisation main scheme account, needs to be added back to your income for student loan and WfFTC if you claimed a deduction for it in your tax return.

Do this by entering the amount of the deposit at Question 22.

Refunds from your income equalisation main scheme are included as income in your tax return but not included for student loan and WfFTC income. Enter the amount of any refund you received (excluding interest earned on the deposit) at Question 23 and Inland Revenue will reduce your income for student loan and WfFTC.

Do not include refunds from the adverse event income equalisation scheme and thinning operations.

If you’re a major shareholder in a close company on the last day of the company’s income year, you may need to include company income for student loans and WfFTC.

Inland Revenue need the following information to calculate the adjustment:

Question 24—company’s net total income for the company’s income year

Question 25—percentage of shares you held in the company on the last day of the company’s income year

Question 26—total dividends paid by the company for the company’s income year

If you’re a major shareholder in more than one close company, you’ll need to do separate calculations for each company.

The trust’s income, company’s total income or company’s total net income must be adjusted to include the full amount of any refunds or deposits to the main income equalisation scheme in order to reverse its effect.

If you receive WfFTC, you also have to include the attributed income of any dependent children who have a voting interest in a company (whether you hold any voting interests in that same company or not). Please give Inland Revenue the following information:

Question 27—company’s net total income (gross income less expenses) for the company’s income year

Question 28—percentage of shares your dependent child/children held in the company on the last day of the company’s income year

Question 29—total dividends paid by the company for the company’s income year.

If you’re a major shareholder in more than one close company, you’ll need to do separate calculations for each company.

The trust’s income, company’s total income or company’s total net income must be adjusted to include the full amount of any refunds or deposits to the main income equalisation scheme in order to reverse its effect.

Terms Inland Revenue use

Adjustment—Additional income types to be included that are not part of taxable income, or have the effect of adding back into your income a deduction or remove an amount of income that is part of your taxable income but is not included for WfFTC and/or student loan purposes.

Annuities—An annuity is a fixed figure that will provide income from a life insurance policy.

Attributed income—As a major shareholder in a company, you may have the ability to access the year’s retained earnings of the company for your own private expenditure.

Close company—A company where five or fewer persons hold more than 50% of the shares in the company. If the shareholders are associated they are counted as one person.

Distributions—Amounts paid to a member of a retirement savings scheme or a beneficiary of a trust that are generally not taxable income.

Employer-provided short-term charge facilities—A business credit card, business charge account or a voucher for your own use, for example, fuel card, shop card or grocery vouchers.

Income equalisation main scheme—This scheme allows eligible farming, fishing or forestry customers to even out fluctuations in income by spreading their gross income from year to year.

Other payments—Extra payments you generally receive from family or friends, to help with mortgage or other household expenses, for example, payments towards groceries, power or phone bills. It’s not your income, which you pay tax on. They can be paid to you or direct to a bank, service provider or agency on your behalf.

Passive income—Income from interest, dividends, Maori authority distributions, beneficiary income, royalties, rents, attributed PIE income and dividends from a listed PIE.

Principal caregiver—The person who has on a day-to-day basis the primary responsibility for a dependent child, but not in a temporary arrangement.

Settlor—Generally a settlor is a person who transfers value in cash or kind to the trust for the benefit of the beneficiaries. You are also a settlor if you provide financial assistance to a trust (or for the benefit of the trust) with an obligation to pay you back on demand, and you don’t ask the trust to pay you back or you defer making the request for repayment.

Tax resident—You’re a tax resident in New Zealand if you’re in New Zealand for more than 183 days in any 12-month period, or have a “permanent place of abode” in New Zealand, or you’re overseas in the service of the New Zealand government.