IR3 ACC personal services rehabilitation payments

If you’ve had a workplace injury your employer may manage these payments rather than ACC. If you or your caregiver receive these payments, regardless of whether ACC or your employer makes them, you’ll need to read this information before you complete your return.

Any ACC personal service rehabilitation payments paid by ACC or your employer direct to the client or caregiver, are schedular payments and will have tax deducted before the payments are made.

Depending on their circumstances, ACC clients or carers receiving ACC personal service rehabilitation payments may not be required to file an IR3.

Do I need to file?

Question 12 Schedular payments

Question 12C Expenses related to schedular payments

If you’ve kept some of the income

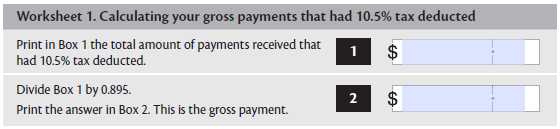

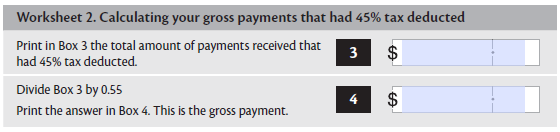

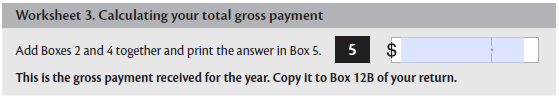

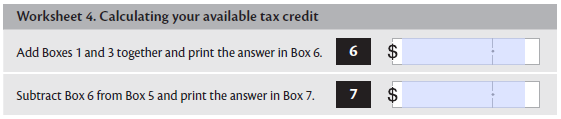

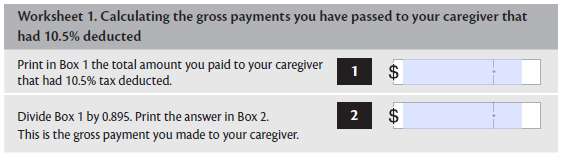

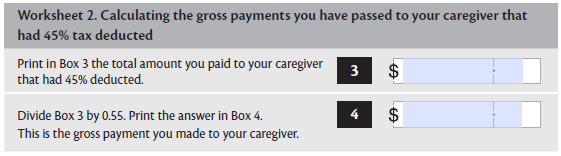

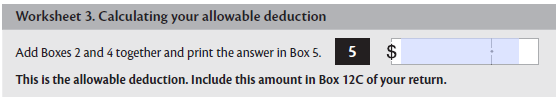

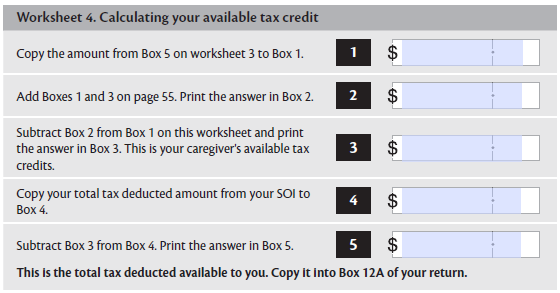

To help determine your allowable deduction, you’ll first need to determine your caregiver’s gross payments. Complete worksheets 1 to 3 and include the amount from Box 5 at Box 12C of your IR3 return.

Please attach a copy of the payments you made to your caregiver(s) with your IR3.

More information

If you have any questions about your tax please go to the Inland Revenue website www.ird.govt.nz