Question 11 Income with tax deducted

If you received family tax credit from Work and Income, copy the amount from your SOI to Box 11 if it doesn't already show.

Don’t include any Working for Families Tax Credits from Inland Revenue in Box 11.

Question 11A Income with tax deducted

Did you receive any of these types of income with tax deducted between 1 April 2018 to 31 March 2019?

salary or wages

a student allowance

any income-tested benefit—unemployment or sickness, transitional retirement, independent youth, domestic purposes, widow’s, invalid’s or emergency

accident compensation payments related to earnings

New Zealand Superannuation (NZ Super) either income-tested or non-income tested, or a veteran’s pension

other pensions, annuities or superannuation (read “Pensions”)

free or discounted shares received under an employee share scheme (previously known as a share purchase agreement). Note: it is up to your employer whether they deduct tax on these or not

shareholder-employee salary.

If you received any of these types of income with tax deducted, you need to copy the totals from your SOI to Question 11A if they don't already show on your return.

Employee Share Scheme (ESS) benefits

If you (or an associate) received free or discounted shares under an employee share scheme the taxable value will be included on your SOI as long as your employer has provided us with this information.

In most cases your employer will have provided this information but if they haven’t you will need to show the taxable value at Question 24.

You will need to check with your employer whether this information has been provided.

What to show on your return

Copy the total amounts from your SOI to the corresponding boxes (11A, 11B, 11C, 11D and 11E) on your return if it doesn't already show.

Amending your income details

If any of the details on your SOI are incorrect (for example, wrong or missing employers), please make the changes on your SOI and attach it to your income tax return.

You only need to attach your SOI to your income tax return if you’ve made changes to it.

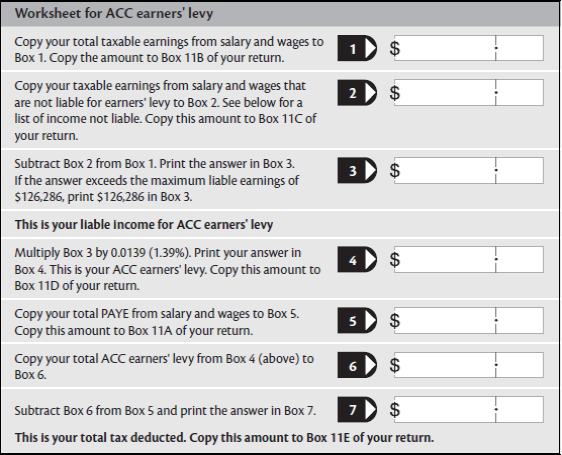

Please transfer the amended totals from your SOI to the corresponding boxes on your return and use the Worksheet for ACC earners’ levy to calculate your total tax deducted (11E).

ACC earners’ levy

All employees must pay an ACC earners’ levy to cover the cost of non-work related injuries, based on their earnings. Inland Revenue collect this on behalf of the Accident Compensation Corporation (ACC). The maximum amount of earners’ levy is $1,755.37. The earners’ levy is set at a rate of 1.39% (1.39 cents in the dollar).

If you need to amend your employment details on your SOI, you’ll need to recalculate your earners’ levy.

Using employer-provided information

If you received payslips or other earnings information from your employer, you can use this information to complete your return and don’t have to wait for your SOI. You don’t include schedular payments in this calculation.

You’ll need to use your total PAYE deducted in your calculations. This is the amount of PAYE shown on your payslips before any tax credits for payroll donations are deducted.

If you made donations through payroll giving to an organisation that is not on Inland Revenue’s approved donee organisations list, you won’t be able to keep the tax credits you received and you won’t have paid enough PAYE throughout the year. You’ll have either received a letter telling you about these extinguished tax credits or they’ll show on your Summary of income. Put the total PAYE, less the amount of your extinguished tax credits, in Box 11A.

If the amount of total PAYE deducted isn’t clear from your payslips:

contact your employer, or

refer to your SOI for details, or

refer to “Account information” in the my income tab in myIR, or

call Inland Revenue on 0800 227 774.

You’ll need to calculate your ACC earners’ levy liability and deduct it from your total PAYE, using the Worksheet for ACC earners’ levy.

Worksheet for ACC earners' levy

The following income isn’t liable for ACC earners’ levy

NZ Super

income-tested benefits

non-taxable allowances

student allowances

veteran’s pension

living alone payments

redundancy payments

retiring allowances

jury and witness fees

interest and dividends

taxable Maori authority distributions

free or discounted shares received under an employee share scheme

income from a partnership earned by a non-working partner in that partnership

pensions from superannuation schemes not registered with the Financial Markets Authority

overseas pensions

rents

estate and trust income

royalties

income attributed to you from a portfolio investment entity (PIE)

income arising from a withdrawal from foreign superannuation schemes.

Pensions

Don’t include the following pensions or annuities in your tax return:

non-taxable pensions or annuities from either life insurance funds or superannuation schemes registered with the Financial Markets Authority (for example, Government Superannuation)

pensions that are completely tax-free, such as war pensions (other than a veteran’s pension).

Any overseas social security pension you receive is taxable. Include it at Question 17 (see the notes at Overseas pensions)

If you receive a United Kingdom national retirement pension and have joined the special banking option operated by Work and Income, include the income and tax deducted at Question 11A.

For more information about overseas pensions read Overseas pensions.