IR3 Question 30 Independent earner tax credit (IETC)

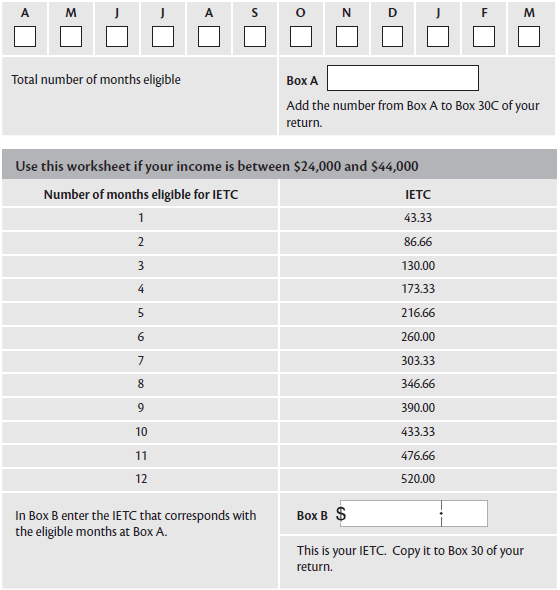

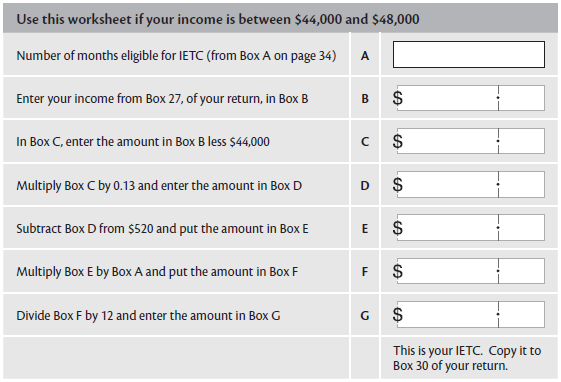

You can calculate your IETC:

by using the worksheets provided in this section

by calling the Inland Revenue self-service line.

IETC

The IETC is a tax credit for individuals whose annual net income* is between $24,000 and $48,000. Your annual net income is shown at Box 27 “Income after expenses” in your return.

* Net income means your total income from all sources, less any allowable deductions or current year losses (not including any losses brought forward).

If you’re eligible for IETC, but earn over $44,000, your annual entitlement to IETC decreases by 13 cents for every dollar earned above $44,000.

For the period 1 April 2018 to 31 March 2019, you’ll be entitled to IETC for any months:

you were a New Zealand tax resident

you or your partner weren’t entitled to Working for Families Tax Credits (or received an overseas equivalent) and you didn’t receive:

an income-tested benefit

NZ Super

a veteran’s pension or

an overseas equivalent of any of the above.

You’re a tax resident if you lived in New Zealand for more than 183 days in the last twelve months, or have a permanent place of abode in New Zealand. For more information, read the guide New Zealand tax residence (IR292).

To work out the months you’re entitled to this tax credit, use the total number of whole months the criteria applied to.

If you didn’t meet the above criteria for even one day of any month you won’t be entitled to IETC at all for that month, so don’t include it in your calculation.