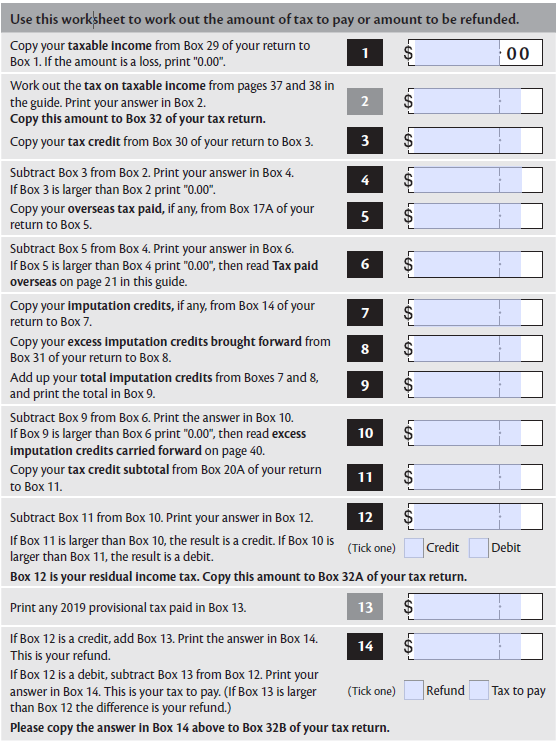

IR3 Question 32 Tax calculation

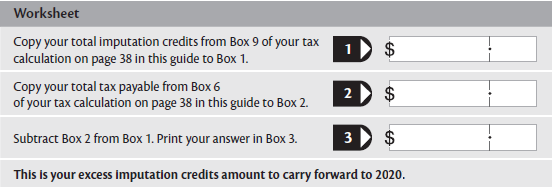

Excess imputation credits carried forward

Imputation credits are treated differently from RWT. If you received dividends from a New Zealand company that gave you imputation credits or an Australian company that gave you New Zealand imputation credits, you may have excess imputation credits to carry forward. This will only happen if your total imputation credits (including any excess imputation credits brought forward from 2018) are greater than your total tax payable.

Use the worksheet below to work out the excess imputation credits that must be carried forward to your 2020 tax return. Inland Revenue will send you a letter confirming the amount.

Student loan

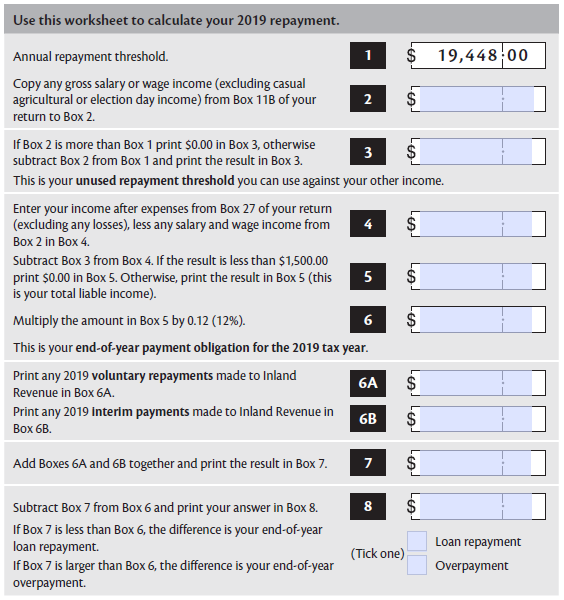

Inland Revenue will work out how much of your student loan you need to repay, based on your income. If you have an end-of-year repayment obligation Inland Revenue will send you a notice showing how much is due. If you want to calculate the amount yourself, either use the worksheet provided here or go to “Work it out” on the Inland Revenue website. The worksheet is for your information only and will give you an indication of your student loan end-of-year repayment obligation.

Interest-free student loan

If you’ve lived in New Zealand for six months (183 days) or more, your student loan is interest-free. Interest will be charged and then written off on a daily basis.

Even if you haven’t been in New Zealand for six months, you may qualify for an interest-free student loan if you meet the criteria for an exemption.

Go to the Inland Revenue website www.ird.govt.nz (search keywords:interest free) for more details.

End of year repayment obligation

Repayment deductions from salary or wages are generally considered your final obligation on that income and don’t form part of your end-of-year repayment obligation.

Income from casual agricultural work and election day work doesn’t have student loan deductions. This income is excluded as salary and wage income and becomes part of adjusted net income.

If you have a loss from an investment or business activity, any income or deductions are excluded in calculating your adjusted net income. If you have separate business or investment activities which are normally carried out in association with each other, you can offset a loss from one business or investment activity against other like income. For example, Rory has an overall loss from his landscaping business of $7,500. He has also made a profit from his lawn-mowing service of $50,000. The activities are carried out in association with each other, so Rory can claim the $7,500 loss against the $50,000 profit.

From the 2015 tax year onwards income adjustments are now required to be part of your adjusted net income. For a full list of the adjustments required go to www.ird.govt.nz (search keywords: adjust your income).

You’ll only have an end-of-year repayment obligation if you:

have adjusted net income of $1,500 or more with a total income (including salary or wages) of $20,948 (annual repayment threshold plus $1,500) or more

had an interim assessment for the year.

Adjusted net income is your annual gross income, excluding salary or wages and less annual total deductions you may claim. If you have a loss from an investment or business activity, neither the income or the deductions from that activity are included in calculating your adjusted net income. If you have separate business or investment activities which are normally carried out in association with each other, a loss from one business or investment activity can be offset against other like income.

Annual total deductions are the expenses and deductions you can claim for the tax year.

If you are required to file an Adjust your income (IR215) form, you will be unable to use this worksheet to calculate your 2019 repayment obligation. Once Inland Revenue has have received your IR3 and your IR215 they will send you your end-of-year repayment obligation for 2019.