IR3 Question 33 Early payment discount

An early payment discount is available for people who:

are new in business

haven’t begun to pay provisional tax

made payments within the corresponding income year up to their balance date, for example, a standard balance date taxpayer, who has made a payment or payments on or before 31 March 2019 as income tax for the period 1 April 2018 to 31 March 2019.

The discount is calculated at the rate of 6.7% of either:

the amount paid during the year, or

105% of your end-of-year residual income tax liability,

whichever is the lesser, and is credited against your end-of-year tax bill.

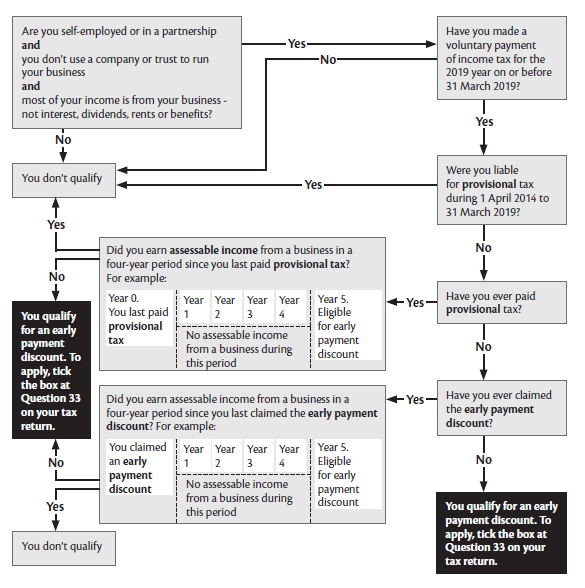

To check if you qualify, work through the flowchart below.

Do you qualify for an early payment discount?

Terms Inland Revenue use:

Term | Meaning |

|---|---|

| Provisional tax | This is tax paid in instalments during the year, based on what you expect your income to be, or what it was last year. |

| Assessable income | Income that is not exempt income or excluded income (for example, a government grant to a business). Assessable income includes undeclared business income you may have earned (for example, cash jobs). |

| Year | As referred to in the diagram on the next page, year means the standard tax year from 1 April to 31 March, unless you have an approved different balance date, in which case your income year will end then. |

If you have any questions about your entitlement to the discount, please contact Inland Revenue.