IR3NR Paying your tax

If you have tax to pay, you must pay it by 7 February 2020. If you have an agent and a standard balance date you may have until 7 April 2020 to pay. If you think this may apply to you, please contact your agent for more information. You can pay earlier if you want to.

How to make payments

Go to www.ird.govt.nz/pay to pay online or find out about these other payment options:

making electronic payments

using a credit or debit card

posting a cheque.

Or you can call Inland Revenue on 0800 775 247.

Late payment

Inland Revenue may charge you a late payment penalty if you miss a payment or it’s late. They will also charge you interest if you don’t make your tax payment by the due date.

If you can’t pay your tax by the due date, call Inland Revenue on 0800 775 247. They will look at your payment options, which may include an instalment arrangement, depending on your circumstances.

Go to www.ird.govt.nz (search keywords: managing penalties) for more information.

Your record of payment

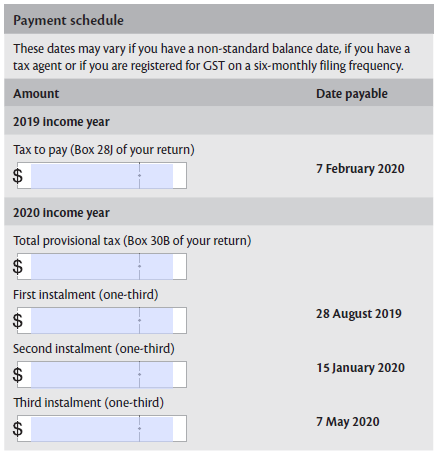

When you’ve worked out how much you have to pay, write the amounts on the schedule below. Keep the schedule as your record so you don’t miss a payment.