IR3NR Question 29 Refunds and/or transfers

If you’re entitled to a refund, you may:

have it direct credited to the New Zealand bank account shown at Question 7 or other deposit account, for example, a building society account shown at Question 7

transfer all or part of it to cover someone else’s income tax debit

transfer all or part of it to pay your 2020 provisional tax

receive it by cheque. All cheques are issued in New Zealand currency.

If you’ve made payments towards your 2020 provisional tax and, after completing this return, you find that you have less or no provisional tax to pay, the overpayment can be included in the amount Inland Revenue refund or transfer. Print the overpaid amount in Box 29B.

Are you entitled to an early payment discount?

The early payment discount is available for people who:

are new in business, and

haven’t yet begun to pay provisional tax, and

in the case of a standard balance date taxpayer, have made a payment or payments on or before 31 March 2019 for income tax for the period 1 April 2018 to 31 March 2019.

The discount is calculated at the rate of 6.7% of the lesser of either:

the amount paid during the year, or

105% of your end-of-year residual income tax

and is credited against your end-of-year tax bill.

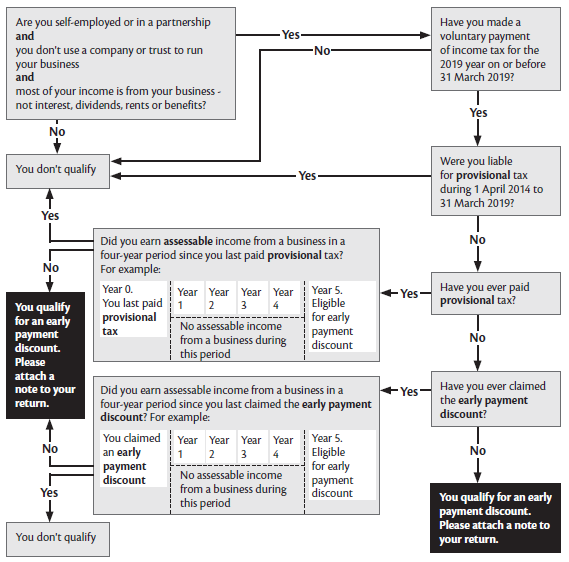

To check if you qualify, work through the flowchart below.

Terms Inland Revenue use

Provisional tax—this is tax paid in instalments during the year, based on what you expect your income to be, or what it was last year.

Assessable income—income that is not exempt income or excluded income (for example, a government grant to a business). Assessable income includes undeclared business income you may have earned (for example, cash jobs).

Year—as referred to in the diagram below, year means the standard tax year from 1 April to 31 March, unless you have an approved different balance date, in which case your income year will end then.

If you have any questions about your entitlement to the discount, please contact Inland Revenue.