IR4 Question 13 New Zealand interest

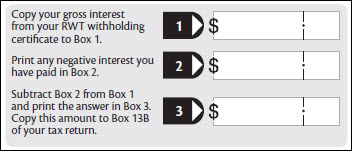

Interest from all New Zealand sources must be shown in the return. Write the total of all RWT deducted in Box 13A. If the company has had NRWT deducted from New Zealand interest, include this in Box 13A. Add up all the gross interest amounts (before the deduction of any tax) and write the total in Box 13B.