IR4 Question 38 Lowest economic interests of shareholders

The ownership tests measure a shareholder’s voting and market value interests in a company. They apply to the net loss carry forward and grouping provisions, imputation credit carry forward provisions and the qualifying company rules.

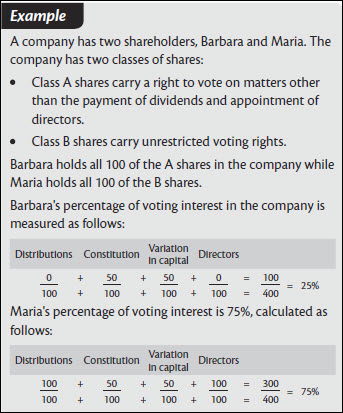

A shareholding individual’s economic interest in a company will generally be measured by referring to the percentage of voting power they hold in that company.

The percentage of voting interest is the total percentage of rights a person has, by reason of their holding of shares (and options), to vote on:

the dividends or other distributions to be made by the company

the constitution of the company

any variation in the capital of the company

the appointment or election of directors.

The continuity thresholds will be satisfied by taking into account the lowest economic percentage of rights attached to shares held by each shareholder of a company.

If Barbara and Maria hold these proportions of shares for the entire income year, the “total lowest economic interest of shareholders” or the minimum continuity is 100%, because Barbara’s 25% plus Maria’s 75% equals 100%.

If the proportion of shares held does not change during the entire income year, the total lowest economic interest of shareholders will always be 100%, as shown in the example below:

Example

On 1 September 2018 Barbara and Maria swapped shares and held these proportions to 31 March 2019, the company’s balance date.

| 1 April 2018 | 1 Sep 2018 | 31 Mar 2019 | Lowest |

|---|---|---|---|---|

Barbara | 25% | 75% | 75% | 25% |

Maria | 75% | 25% | 25% | 25% |

The lowest percentage of rights held by each shareholder during the income year is 25%. So, the total lowest economic interest of shareholders, or the minimum continuity, is 50%.

In certain circumstances the shareholders’ economic interests in a company will also be determined by the market value interests in the company. This is where the voting interests don’t reflect the true economic interests held in a company.

A shareholder’s market value interest in a company equals their percentage share of the total market value of shares (and options) held in that company.

The specific factors that require a market value interest to be calculated are called market value circumstances. A market value circumstance exists where:

the company has on issue debentures to which sections FA 2 and FZ 1 of the Income Tax Act 2007 apply

the company has on issue shares where payment of dividends is guaranteed by a third party

there’s an option to acquire shares in the company

an arrangement exists with the purpose of defeating a provision that depends on measurement of voting and market value interests.

Add together the lowest economic interest of each shareholder and print the total in Box 38. Write percentages in the following format, for example, show 50% as 50.00, and 100% as 100.00.