IR6 Question 24 IR6B Estate or beneficiary details

Beneficiary income and calculation of tax, excluding minor beneficiaries

Question 24

See Question 18A on pages 28 and 29 for the definition of beneficiary income. Complete the details on the IR6B for each beneficiary and ensure an IRD number is shown for each. If you don’t have the beneficiary’s IRD number contact the beneficiary. Due to Inland Revenue’s privacy obligations under section 81 of the Tax Administration Act 1994 Inland Revenue cannot provide it to you.

Non-resident beneficiaries

Question 24B

Please make sure you answer Question 24B about residency. This lets Inland Revenue work out correctly how the beneficiary income should be taxed.

Include all beneficiary income allocated to each non-resident beneficiary in Boxes 24C, 24D, 24E, 24F and 24G. Remember, the combined totals at Boxes 24H, less any taxable distributions from foreign trusts included at Box 24G must reconcile with the total of Box 18A.

Non-resident passive income

Non-resident passive income is interest, dividends and royalties for the supply of scientific, technical, industrial or commercial knowledge. These types of income are subject to non-resident withholding tax (NRWT) if the income has a New Zealand source.

This tax is deducted when the non-resident passive income is paid or credited to a non-resident beneficiary. The rates and methods of calculating the tax on a non-resident beneficiary’s share of income differ according to the type of income derived and the country the beneficiary is resident in.

Include all income derived by each non-resident beneficiary in Boxes 24C, 24D, 24E, 24F and 24G.

Paying NRWT

When paying non-resident passive income to a non-resident beneficiary, the trust must complete certain forms and pay NRWT.

If you need more help, see the NRWT – payer’s guide (IR291).

When calculating the amount of income liable for income tax at the ordinary rates, don’t include non-resident passive income or any overseas income in the taxable income figure in Box 24H for non-resident beneficiaries.

New Zealand interest

Question 24C

If the allocation of beneficiary income includes any New Zealand interest, write the amount in Box 24C.

New Zealand dividends

Question 24D

If the allocation of beneficiary income includes any New Zealand dividends, write the amount in Box 24D.

Maori authority distributions

Question 24E

If the allocation of beneficiary income includes any Maori authority distributions, write the amount in Box 24E.

Overseas income

Question 24F

If the allocation of beneficiary income includes any overseas income, write the amount in Box 24F.

Other income and taxable distributions from a foreign trust

Question 24G

Add the remainder of any beneficiary income allocated to the beneficiary to any taxable distributions from a foreign trust and write the total in Box 24G.

Taxable income of beneficiary from the estate or trust

Question 24H

Add up boxes 24C to 24G and write the total in Box 24H.

Paying the tax on beneficiary income, excluding minor beneficiaries

Question 24I

The trustee must pay tax on behalf of the beneficiary for all income allocated to the beneficiary. However, the Trustee and the beneficiary can agree not to have tax deducted from Trust/Estate income before the beneficiary receives it. This might be done where the beneficiary has losses available to offset income.

The trustees will be liable if the beneficiary defaults on payment of the tax obligations on trust income.

Select Yes if the estate or trust is paying the tax on behalf of beneficiaries, then complete all boxes 24A to 24S.

Yes means the trust/estate will retain any excess tax credits (except overseas credits and Imputation credits) for the trust/estate. The beneficiary must then show the gross income allocated to them as trust income and can only claim the amount of tax paid by the Trust at key point 24K, in the key point for Tax Paid by Trustees of their own income tax return.

Select No if the estate or trust is not paying the tax on behalf of beneficiaries. Then complete boxes 24A to 24J, and boxes 24L, 24N and 24P only.

Taxable distributions by non-complying trust

Question 24J

Show taxable distributions to each beneficiary in Box 24J and the tax in Box 24R. Taxable distributions by a non-complying trust are taxable to the beneficiary at a flat rate of 45 cents in the dollar.

Calculation of tax

Question 24K

Do not fill out Box 24K if you ticked No in Box 24I.

If the estate or trust is paying tax on behalf of the beneficiaries calculate tax on taxable income of beneficiaries using the rates below.

2019 annual tax rates income range | Tax rate |

|---|---|

Income to $14,000 | 10.5% |

$14,001 - $48,000 | 17.5% |

$48,001 - $70,000 | 30.0% |

$70,001 and over | 33.0% |

Beneficiary’s share of overseas tax paid

Question 24L

Allocate any tax paid overseas to beneficiaries on the same basis as the allocation of income.

Minor beneficiaries’ share of overseas tax is to be offset against tax payable on trustee income.

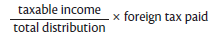

A New Zealand resident who receives a taxable distribution is not allowed a tax credit in relation to any income tax paid unless the tax is the same as non-resident withholding tax (NRWT). The amount of any credit is equal to:

Calculation 24M

Question 24M

Do not fill out Box 24M if you ticked No in Box 24I.

Subtract Box 24L from Box 24K.

If the overseas tax paid (Box 24L) allocated to a beneficiary is greater than the tax payable in Box 24K, print 0.00 at Box 24M.

Beneficiary’s share of dividend imputation credits

Question 24N

If dividends have been allocated to a beneficiary, use the following formula to work out the credits attached to those dividends:

a is the total of all dividend imputation credits attached to all dividends distributed to beneficiaries during the income year

b is the total distribution, including capital distributions made to the particular beneficiary during the year

c is the total distribution, including capital distributions made to all beneficiaries during the year.

Show the beneficiary’s share of imputation credits in Box 24N.

Calculation 24O

Question 24O

Do not fill out Box 24O if you ticked No in Box 24I.

Subtract Box 24N from Box 24M.

If the beneficiary’s share of the imputation credits is larger than their tax payable in Box 24M, the excess credit cannot be refunded to the trust. Write 0.00 in Box 24O. The beneficiary should claim the balance of the unused imputation credits in their own tax return.

Minor beneficiaries’ share of dividend imputation credits is to be offset against tax payable on trustee income in box 25E of the IR6.

Beneficiary’s allocation of RWT and other credits

Question 24P

Minor beneficiaries’ allocation of RWT and other credits is to be offset against tax payable on trustee income.

Ensure that you include the following amounts in Box 24P for each beneficiary:

allocation of RWT (Boxes 9A and 10A)

share of Maori authority credits (Box 11A)

share of partnership, estate or trust tax credits (Box 12A)

share of LTC tax credits (Box 14A)

share of other income credits (Box 16A).

If income from a property sale is treated as beneficiary income show their share of any residential land withholding tax credit (Box 16AA).

Don’t include any amounts already shown in either Boxes 24L or 24N of the IR6B.

Questions 24Q & 24S

Do not fill out 24Q or 24S if you ticked No in Box 24I.

Question 24R

Calculate tax on taxable distribution by non-complying trust in 24J at 45 cents in the dollar and print in this box.